[ad_1]

Nicolino

To be clear at the outset, Nuveen’s NASDAQ 100 Dynamic OverwriteNASDAQ:QQQX) like the ProShares Ultra QQQ ETF (QLD) isn’t the only one of those funds that holds and allows Nasdaq stocks. To profit from the growth in the price of technology stocks, perhaps after a recent rally Purchases Developed by Kathy Wood of Arch Invest.

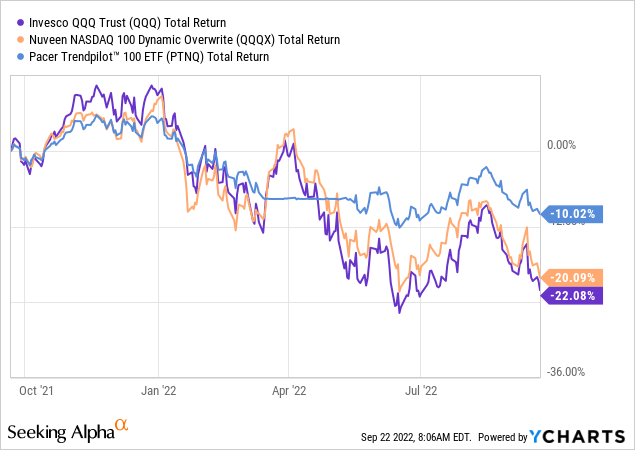

Instead, it offers dividends and uses covered calls to hedge against market weakness. To that end, it dipped less than the tech-heavy Invesco QQQ ETF ( QQQ ) last year, as shown in the total returns orange chart below. For investors, total returns measure price performance and dividends if these are reinvested.

Comparing total returns (www.ycharts.com)

Additionally, for those who are allergic to covered calls, I also include the Pacer Trendpilot 100 ETF ().Bat: PTNQ) is highly successful in preventing volatility, as shown in the pale blue chart above, with only a 10% downside.

However, the information of these charts is not enough to make a decision and the purpose of this concept is to compare between the two ETFs, with the aim of determining which one provides better protection against failure, especially in the current volatile market conditions. .

New market conditions require a different approach

As noted at the Jackson Hole Symposium in late August, the Federal Reserve is ready to “do whatever it takes” to fight inflation, even a slowdown in the economy. After being behind the curve in the first half of the year (fighting inflation), the objective is now to avoid stagflation at all costs. Also, with interest rates rising sharply and the Federal Reserve shrinking its balance sheet, it’s bad for tech stocks, which support their high growth rates compared to cyclical companies with large amounts of cash. At the same time, the strong dollar is a headwind for technology sales to the rest of the world.

In fact, while the Nasdaq suffered more than 22%, as shown in the blue chart below, the damage was limited to less than 13% for the S&P 500.

Comparing the performance of the S&P 500 and the Nasdaq. (www.seekingalpha.com)

This requires a mindset shift away from a strategy that involves profiting from the movement of the Nasdaq, buying and selling the bait. Along the same lines, holding onto mega-cap tech stocks for capital appreciation has worked well for more than a decade, but now things have changed with volatility looking to become a new constant.

In these circumstances, some may prefer more “value” names, but with a recession looming, more cyclical stocks may have a tougher time ahead. So the “high-growth disruptive technology” part of the Nasdaq hasn’t completely lost its luster. To this end, renowned investor Cathy Wood spent more than $40 million to buy tech stocks two weeks ago. However, not everyone has her “skill” but it’s worth exercising some moderation in getting into technology and also earning some income in the process.

For this purpose, I will begin by evaluating the value of Nuven ETF.

QQQX, covered calls and high earnings

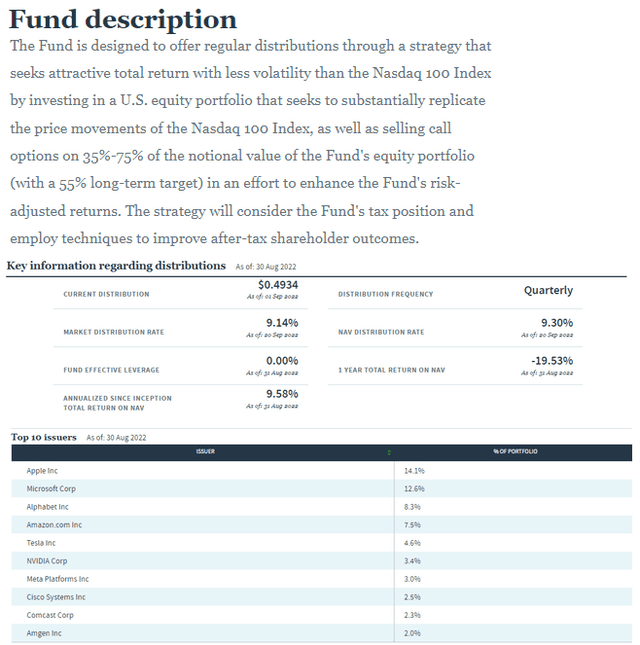

QQQX seeks to provide a less volatile total return than the Nasdaq 100 Index. It does this by first investing in stocks that replicate the price movement of a tech-heavy index, and second by selling call options that vary from 35% to 75% of the underlying fund’s value, with a midpoint. It forms a long-term target of 55% (pictured below).

QQQX Statement and Holdings (www.paceretfs.com)

For those unfamiliar with covered calls, a covered put option strategy involves taking out put options while maintaining a short position equal to the corresponding shares held. The investor will then short the underlying securities by selling the underlying assets, one of the benefits of this strategy is income generation. This is the reason why the fund offers a high dividend yield of 9.14% and pays quarterly. For that matter, as seen in the top ten issuers listed above, QQQX holds stocks that pay dividends.

On the other hand, the main disadvantage of this strategy is that it has limited upside potential if the stock price drops significantly. In this regard, the 20% fall on the entry chart shows that this was the case. Furthermore, the high dividend yield shows that the fund managers have chosen a strategy that prioritizes regular income.

As for the Pacer ETF, it uses a completely different strategy.

PTNQ, from T-Bills aims for capital protection

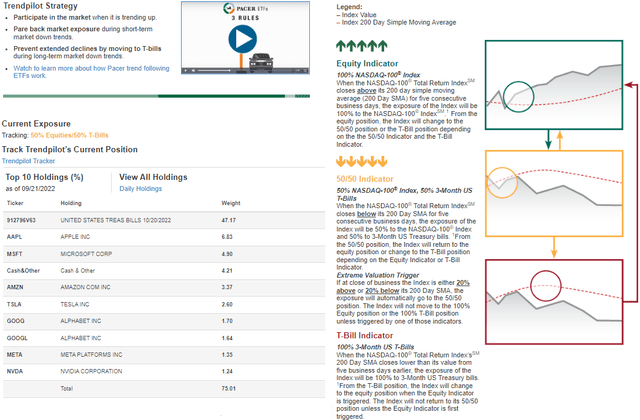

PTNQ tracks Pacer’s NASDAQ-100 Trendpilot data, aiming to participate in the market when things are good and pull back when things are bad. Going deeper, while the NASDAQ-100 Total Return Index has closed above the 200-day SMA (Simple Moving Average) for five consecutive business days, indicating a bullish pattern for technology stocks, PTNQ is fully (100%) exposed to the NASDAQ-100 Index.

Pacer strategy and current exposure (www.paceretfs.com/)

On the other hand, when a reversal occurs or the NASDAQ-100 Total Return Index closes below the 200-day SMA for 5 days, this indicates a bearish pattern for the technology. At this point, PTNQ’s composition changes to 50/50, or 50% allocated to the NASDAQ-100 index and 50% to 3-month US Treasury bills.

Between these two positions, the index uses the 50/50 and T-Bill indicators as shown in the diagram above.

This may sound a little complicated, but as you can see in the opening chart, this strategy clearly works while holding the technology companies that are part of the NASDAQ-100, while PTNQ kept investors from experiencing extreme volatility. Thus, it has experienced a 10% decline over the past year, compared to 22% for the QQQ and 13% for the S&P 500.

Compare with QQQ in mind

Thus, both PTNQ and QQQX provide exposure to Nasdaq 100 stocks, while their respective managers aim to hedge against volatility, while the Nuveen ETF also provides income priority.

Now, over time, US giants have become benchmarks for the tech sector, as they represent innovation and growth while at the same time bringing stable cash flow. But in a market that has been used to cheapen money for more than a decade, the Fed’s draining of liquidity from the system is raising doubts. In these circumstances, unless you have a portfolio that includes treasuries in addition to stocks and are willing to make quick changes based on market sentiment, owning PTNQ is beneficial, but since it is primarily capital-focused, it will not pay dividends to hold.

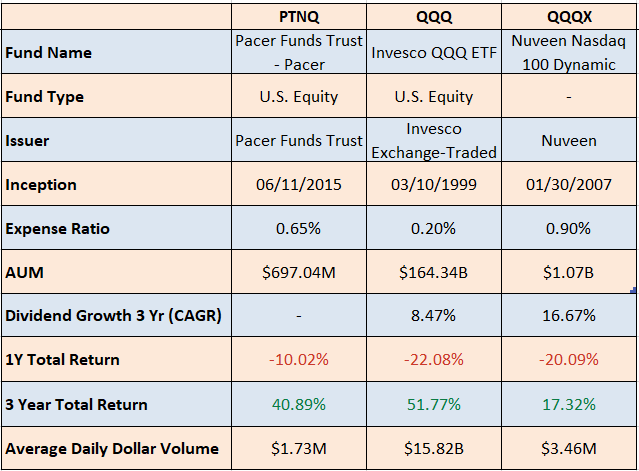

For income, it’s preferable to own QQQX, which holds about 60% of the combined largest technology, communications and healthcare companies, and has grown yields faster than QQQ itself, but charges a higher payout of 0.9%, as shown below. .

Comparison of measurements (www.seekingalpha.com)

However, as its one-year total return is only 2% higher than the QQQ, it is highly debatable whether the QQQX can achieve its objective of “attractive total return with less volatility than the Nasdaq 100 Index.” Also, it shows that its three-year total earnings have fared worse than QQQ despite paying a higher yield. For investors, as I mentioned earlier, total returns include dividends if these are reinvested.

Conclusion

Therefore, it is better to avoid QQQX unless the purpose is to earn.

What’s more, as shown in the chart above, investors who have remained loyal to the powerful Invesco ETF have seen their capital appreciate more than 50 percent over the past three years. This period also includes the spring 2020 covid market crash, which was quickly defeated by the Fed’s monetary policy, but the following years are unlikely to be the same. Things could be very different with the US central bank’s intention to keep hiking the federal funds rate until it reaches 4.6% sometime in 2023. The last time this happened was in December 2007, and this month coincided with the first one. The Great Financial Crisis that ended in 2009.

Under these conditions, those looking to stay out of favor expect the Fed chairman to blink if the CPI (consumer price index) stabilizes from its August peak or fears of a recession take precedence over inflation. , can opt for PTNQ. Based on immediate indicators, PTNQ could fall to the $49.70 level, creating a buying opportunity, but, in the event, there is any news about liquidity problems, the share price could fall further.

In this respect, the Pacer ETF offers a better level of capital protection than the QQQX when considering total returns, despite the higher dividend paid by the Nuveen ETF.

Finally, this thesis is not for those who want to stay in cash and plan to enter the market by investing in QQQ to maintain low prices, but rather for those who, inspired by Cathy Wood, want to position themselves, but they look. , at the same time you want to opt for a less risky approach.

[ad_2]

Source link