[ad_1]

zimmytws/iStock via Getty Images

Investment thesis

Signed into law in 2010, the ACA made significant changes to how Americans access health care. One area of focus was moving away from package-based fee-for-service models and implementing a value-based approach to healthcare delivery. Since then, the CMS(Centers for Medicare and Medicaid Services) has been experimenting with different models with different insurers, health care providers and government entities. Daniel Cattel, Assistant Professor of Erasmus University He studied Of these, 18 initiatives have found one thing in common: a focus on primary care. This idea adds to the deal activity seen in Amazon (the primary care market).AMZNreceiving a treatment (oneCVSCVSFinding the Signify (SGFYWalgreensWBAVillage MD, including Clover Health, and a recent wave of new managed care startupsCLOV), and Alignment Health Care (ALHCBoth use preventive care as a strategy to reduce costs. The rationale behind the policy framework is simple: by investing in primary care, the health care system can reduce costly hospitalizations.

This deal activity reflects the magnitude of the opportunity that the CMS payment model transition presents. But the real question is Aguillon’s health (NYSE:AGL) giving such an opportunity? i don’t think so. The hottest asset in the healthcare market today is primary care facilities, and while AGL has partnered with 17 physician groups, producing 2,200 primary care physicians, it does not own the underlying assets, reducing its appeal as an M&A target, comparing the idea to those who like (ashand quality of life health (LFST), primary health care providers, own the underlying assets and derive most of their revenue from the Medicare and Medicaid programs.

When weighing AGL’s business model on its merits, one cannot find meaningful value. Running a hybrid of a reinsurance company and a foreign business, uncompetitive, takes a lot of risk for little return. The company has unlimited loss exposure for patients’ medical expenses, taking away (the risk) from Humana.HUM) and UnitedHealth (UNH) to profit less from risk-sharing agreements, PCPs reap most of the profits. AGL also provides outsourcing services on behalf of its suppliers, maintaining its billing functions.

Income trends

Investors should be aware of several trends shaping the health care industry—especially for companies like AGL that do business in the Medicare market. These trends are driving changes throughout the health care system, including how providers deliver care and how they are paid for that care. However, while health care costs are a burden on the public budget, I do not believe that cutting these services is politically viable for officials or candidates running for office. Indeed, the Healthy People 2030 initiative has expanded national health care goals, as have the 2020 and 2010 initiatives.

AGL earns income from covered Medicare member capital. When he creates new partnerships, his income increases, with a covered life. Given the scope of its focus on America’s elderly population, revenue comes from two sources: 1) insurance companies, Medicare Advantage, and 2) direct contract programs with CMS. Therefore, the company will benefit from demographic trends in the US as baby boomers age and become eligible for Medicare.

The most significant growth driver is intra-state and inter-state expansion through new supplier partnerships. Currently, the company operates in seven states, up from five last year. Recently, it announced new partnerships including Maine, Minnesota, South Carolina and Tennessee, adding nearly a quarter of a million lives to the platform as of January 2023.

Two reasons contribute to the company signing the partnership. First, leadership talent was demonstrated in the ability to build and maintain partnerships with existing and new PCPs and payers (insurance companies). Steve Sale is the former CEO of Health NetCNC) the largest subsidiary. The board includes industry leaders with deep connections and expertise, such as the chairman of the American Physicians Association, a medical association with 300 institutional members. I believe AGL’s management skills will be critical to its success as the company grows and expands beyond its current markets into additional territories.

Second, the company offers an attractive deal to PCPs and insurers, covering the risk for a small fraction of profits. For example, insurers cover exposure to a member’s agreed monthly premium. Conversely, if the enrollee needs additional care, the exposure to medical expenses is unlimited. Let’s say the PCP partners are successful in reducing health costs. In that case, it will only share a small profit while maintaining administrative functions such as collections, invoicing, liquidity support, squeezing profit margins and our collateral rating.

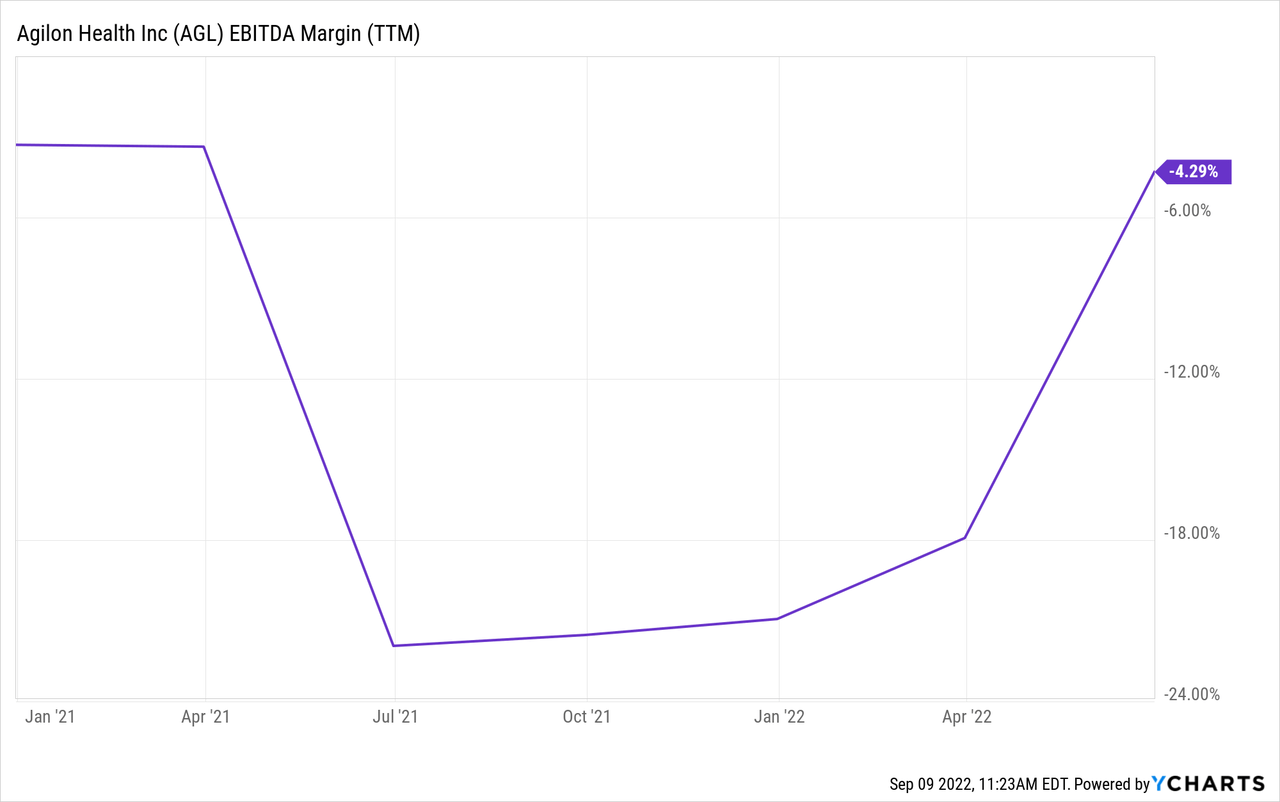

Margin trends

I have no doubt in my mind that AGL will deliver growth for the above reasons. However, there is still a question about the evaluation. The company’s business model is unique in that it leverages CMS’s value-based care initiatives to drive down healthcare costs. However, it lacks a competitive edge. Many insurance companies operate similar risk-sharing programs directly with their provider networks. Moreover, the lack of economies of scale limits the benefits of income growth. Variable costs per subscriber are high.

Finally, it cannot be assumed that the insurance industry, including hybrid models such as AGL, is digging its grave. The Department of Housing and Human Services “HSS” sets Medicare reimbursement rates based on the average cost of care (currently, the average is $10,000 per enrollee per year. The maximum gross margin allowed by insurance companies is 15% – 20% (depending on the amount). However, to encourage value-based care practices, CMS, in some programs, allows insurers to keep any savings they achieve above this gross margin range. Let’s say the industry succeeds in changing standard procedures and lowering the national average cost of care. If so, the HSS could respond by lowering base spending rates. That is the whole point of these initiatives. So, in some sense, I believe that AGLL’s efforts to expand its margins are at least akin to pursuing a long-term journey.

Summary

AGL’s prospects hinge on its ability to reduce the cost of care for its members and protect their health (as indicated by trends in healthcare utilization metrics). So far so good. Margins continue to improve, confirming the positive relationship between ACA-related care and cost reductions. One challenge, however, is maintaining positive margins as PCP expands its partnerships. If it does this successfully, the company can hit a milestone in its growth story. Still, enforcement risks stem from high variable costs, structurally low margins, and exposure to patients’ health care costs that reinsure Medicare Advantage insurance participants without limits. In the long term, margins can be narrowed by the variable base rate set by HSS. For now, the stakes are too high for the stakes.

[ad_2]

Source link