[ad_1]

UK to publish fiscal plan and OBR forecasts on October 31

Just in: Kwasi Kwarteng has moved the date of his Medium Term Fiscal Plan to October 31 to outline the government’s debt reduction plans.

The Chancellor announced the change in a letter to Parliament’s Treasury Select Committee.

The Office of Budget Responsibility’s independent economic forecasts will also be published that day.

The mid-term plan was scheduled for November 23, but Kwartung is facing growing pressure to present the plan sooner.

Key events

Filters Beta

The Nobel Prize in Economics was awarded to Bernanke, Diamond and Dybvig.

Just now: America’s former top central banker has won the biggest prize in economics.

American-based economists Ben Bernanke, Douglas Diamond And Philip Clearly He was awarded the Sveriges Riksbank Prize in Economic Sciences in memory of Alfred Nobel for his research on banks and financial crises.

10 million Swedish kronor (£800,000) will be shared.

Diamond And Clearly Banks are recognized for their work as vulnerable to rumors of potential collapse.

The Royal Swedish Academy of Sciences says:

If a large number of savers rush to the bank to withdraw their money at once, the rumor can become a self-fulfilling prophecy – a bank run will occur and the bank will fail. These risky activities can be prevented by the government providing deposit insurance and acting as a lender of last resort to banks.

Ben Bernanke In the year He shares the award for his academic work analyzing the Great Depression of the 1930s. That knowledge helped Bernanke through the 2008 financial crisis, when he headed the US Federal Reserve.

The verse explains:

Among other things, he showed how banking was a critical factor in the depth and longevity of the crisis. When the banks failed, valuable information about borrowers was lost and could not be quickly recreated.

Society’s ability to channel savings into productive investments is greatly reduced.

Breaking news:

The Royal Swedish Academy of Sciences has decided to award the 2022 Sveriges Riksbank Prize in Economic Sciences in memory of Alfred Nobel to Ben S. Bernanke, Douglas W. Diamond and Philip H. Dybvig “for research on banks and financial crises”.#Nobel Prize pic.twitter.com/cW0sLFh2sj— Nobel Prize (@NobelPrize) October 10, 2022

The pound recovered some of its earlier losses after Kwasi Kwarteng presented the date for the debt reduction plan.

Sterling is now flat on the day, at $1.107.

There is not much monetary reaction as the Chancellor is expected to present his medium term budget plan early….

It will still be on November 23, although there is confusion after he told GB News last week.

Politics Live: Truss is set to benefit, DWP minister hints

Kwarteng’s decision to extend the medium-term budget plan by more than three weeks followed pressure from parliamentarians and financial markets.

After pushing for the scrapping of the 45p top tax rate, some Conservative MPs have been pushing back against the idea that benefits can only rise with incomes, not rising prices.

This morning Victoria Prentice Work and Pensions Minister Truss has given a strong hint that he will back down and give in to Tory demands from all wings of the party who want benefits to improve in line with inflation.

This would mean a large increase for disadvantaged households (as wages do not keep pace with inflation).

In an interview with Sky News, Prentiss said:

It is important to ensure that we target government resources where they are most vulnerable.

Andrew Sparrow Politics Live The blog has all the details

Quasi Quarteng He told him Treasury Committee In the letter:

“I received an initial analysis from the OBR when I came into office, but since then I have made important policy announcements, including the Growth Plan.

“A forecast is essential to include a full and final assessment of the impact of policy measures on the economy and public finances, and therefore, it would not be appropriate to publish the OBR’s preliminary analysis.

“The new forecast date of 31 October will allow the OBR to catch up with data releases such as the latest Quarterly National Accounts and Blue Book revisions.

“The whole process of forecasting allows it to be carried out at a level that satisfies the legal requirements of the Charter of Fiscal Responsibility established by the Parliament and which provides a thorough assessment of the economy and public finances.

“And it will provide time to finalize the medium-term fiscal plan. In the meantime, the Prime Minister and I discussed the economic and fiscal outlook with the OBR’s Budget Responsibility Committee on Friday 30 September, and we will continue to work together throughout the forecasting process and beyond.”

Mel Stride: This could lead to lower interest rates.

Mel Stride MPof Treasury CommitteeHe welcomed the decision to extend the medium-term budget plan to October 31.

Stride suggests the Bank of England is set to raise interest rates in three days – if quasi-quarantine stabilizes markets, then interest rates May not at all It should rise quickly.

Breakdown: I’m very accepting of the decision after going through this hard. @KwasiKwarteng To bring forward @OBR_UK MTFP forecast till 31st October. If this goes well with the market, the MPC meeting on November 3 could result in a small hike. Important for millions of mortgage holders pic.twitter.com/sgn7mB4ovf

— Mel Stride (@MelJStride) October 10, 2022

The market turmoil caused by the small budget of unfunded tax cuts (over £40bn in total) and the associated lack of independent forecasts has put pressure on the chancellor to work out how and what the government will pay for the scheme. It will be their long-term influence.

UK to publish fiscal plan and OBR forecasts on October 31

Just in: Kwasi Kwarteng has moved the date of his Medium Term Fiscal Plan to October 31 to outline the government’s debt reduction plans.

The Chancellor announced the change in a letter to Parliament’s Treasury Select Committee.

The Office of Budget Responsibility’s independent economic forecasts will also be published that day.

The mid-term plan was scheduled for November 23, but Kwartung is facing growing pressure to present the plan sooner.

Investor morale in the euro zone fell for a third straight month, falling to levels that signal a deep recession.

The Sentix index for euro zone confidence fell to -38.3 points this month, from -31.8 in September, the weakest since May 2020, at the start of the pandemic.

The Centics Expectations Index fell to -41.0 from -37.0, hitting its lowest value since December 2008 during the financial crisis.

Sentix chief executive officer Manfred Hubner He said:

At the beginning of October, the Centix economic indices indicated an unchanged difficult economic situation – in Europe, but at the global level. At -38.3 points, the overall Eurozone index sinks to its lowest level since May 2020.

The ongoing uncertainty about the gas and energy situation in the winter has not subsided due to the attack on the Nordstream pipelines. In addition to economic concerns, there is now a growing risk of military conflict in Ukraine. Globally, there is little cause for hope. Currently, only China seems to be somewhat stable.

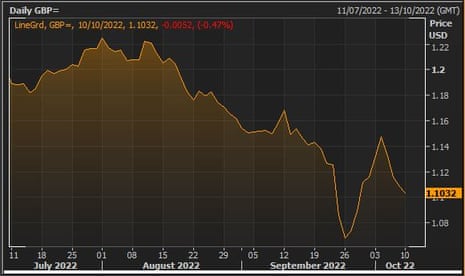

A strengthening dollar sent the pound to its lowest level since late September.

Sterling was down 0.5% at $1.103, below the pre-budget level (but still off the $1.035 low set two weeks ago).

The Russian ruble hit a three-month low as fears grew that Moscow could escalate the war in Ukraine following an attack on Kiev this morning.

The ruble fell to 63 rubles to the US dollar before making a small recovery for the first time since early July.

Russian stocks fell as geopolitical tensions rose, while shares of energy giant Gazprom began trading ex-dividend. Dollar value RTS The index decreased by 6%, based on rubles MOEX Decreased by 4%.

The UK government bond sell-off is gathering pace, with the 30-year gilt now above 4.5% – up 16 basis points (0.16 percentage points) today.

[ad_2]

Source link