[ad_1]

A trader works on the floor of the New York Stock Exchange (NYSE).

Getty Images

The market for high-growth technology companies went south this year as the economy turned and interest rates rose. The bubble valuations of 2020 and 2021 provided an opportunity for noise as investors focused on how unprofitable companies would transition to a dollar.

But the washing process may not reach the end game, according to two top private investors.

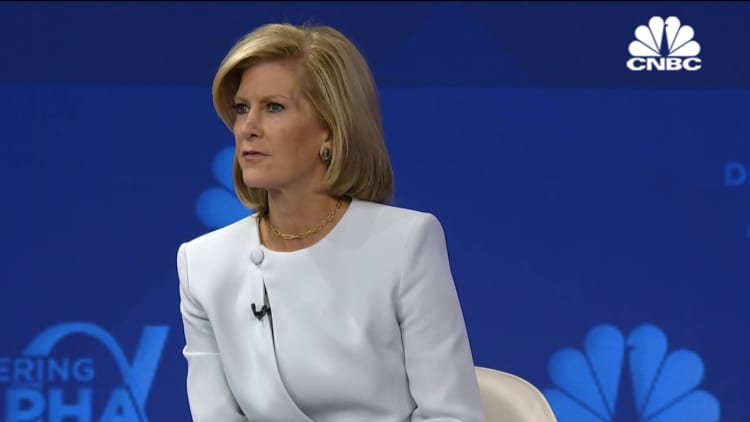

Speaking at CNBC’s Delivering Alpha conference on Wednesday, Orlando Bravo, founder and managing partner of the private equity firm, said the market is high and “immediately priced in,” but not all tech companies and investors. Same page.

Some private sellers have not decided to accept the current valuation reset as valid, and will try to protect this market. For their part, many investors are still unsure whether the valuation results are sufficient.

Investors around the world were happy to buy when rates were zero, regardless of economics, but “now they want profitability, so what’s the value of a company that’s growing at 30% and making no money?” Bravo said. “Is it 20x revenue or 3x revenue? There was no downside to that,” he said.

Bravo said tech companies can weather the cycle and have better valuations, but with the economy slowing down, their problems can only get worse if their earnings drop from zero profits. “If it’s going down every quarter, what’s going to happen in this area?” Bravo said.

Bill Ford, CEO of growth equity firm General Atlantic, has driven a fundamental shift in public markets by reconnecting with fundamentals and “reconnecting with what is the sustainable growth rate of companies.” But that reboot of unprofitable growth companies hasn’t fully translated into private markets.

“It’s going to take some time for entrepreneurs to accept that growth is going to be sold differently, and now we have a bottleneck,” Ford said of the reset, which was forced by declining P/E ratios on the S&P 500. Ford said. “It will clear itself in a few years,” he added.

The IPO market may take years to recover.

Ford cited the 40% average IPO decline from last year as a reason for private markets to correct further in the near term. “It could be several years before the IPO market recovers,” Ford said. Investors need to be able to model long-term growth rates and profitability, which may take some time, he said. And for many high-growth tech names, going public doesn’t seem to work out well for them.

“They didn’t get the benefit of going public,” he said, citing the lack of long-term shareholders in a company and the inability to raise additional capital.

Ford’s message to its portfolio companies about the exit is to focus on extending their horizons, managing costs and key performance indicators for long-term profitability. “Buy time for yourself. That’s what we’re preaching to all of our portfolio companies,” he said. “Find out what the growth drivers are and invest in these areas and wait for a longer runway before going public,” he said.

Both private equity leaders see consolidation among tech companies as a prerequisite for going public in the future. “The public markets require a lot of volume and some of the companies that went public last year didn’t show economic growth,” Ford said. “We will get stronger.”

In recent years, there have been more companies in many of the emerging technology spaces that investors have backed public offerings, Ford said. Typically, markets lose to two or three competitors before the winners become clear to investors, but in the past few years, as many as eight companies in high-growth technology sectors have gone public. “Given how many companies have been created during this cycle, we need that consolidation,” Ford said.

“It can be a terrible time to sell a portfolio company, but it’s a great time to consolidate . . . and you might be better off in the long run,” Bravo said.

Ford said some companies that went public and are now trading at a steep discount and have now missed important growth numbers, as well as companies that don’t approach attractive profitability levels, will go private.

Most of these companies don’t have the capital to act as reinforcements, Bravo added, and find it difficult to motivate employees and demonstrate business strength to customers.

Reduce P&L and protect

Both private equity executives are telling portfolio companies to cut back.

“Our school of thought always maintains a profit and loss statement,” he said. “Live and die by it and never go into margin. You can measure it independently if you don’t have a compelling investment.”

Disruption of technology is unpleasant, but companies must be disciplined when it comes to matching labor and productivity. “There’s been some slowdown in hiring and organizing businesses and slowing down to the point where you see runways on some of them,” Bravo said. “And when things pick up, you’re really ready to invest,” he added.

“It’s not a cut for the sake of cutting,” said Ford. “Make the right investment decisions to support long-term growth,” he said. “One of the things that people completely missed was long-term profitability. They had no idea about long-term operating margins. ‘Am I 10% or 15%?’ .

While the current market is tough, Bravo and Ford both see attractive long-term technology trends. With more investments in business-to-consumer technology, Ford cited the expansion of 5G internet to 80% of the world by 2030 and investments in next-generation semiconductor companies. “We know the Nvidias and the Qualcomms, but in the venture space we’re now seeing new chip companies being built and taking advantage of the opportunity to get out of China,” he said.

Bravo has applied for business-to-business cyber security. “When you look at the big pie of cyber, it has explosive growth, and there are so many threats.”

[ad_2]

Source link