[ad_1]

Ryan Court Inc., a legal technology platform backed by big law firms, is shedding costs after it said the company has eased the challenge of getting clients to buy and use the product.

The Amsterdam-based company is using fewer devices after eliminating physical offices, cutting travel and reducing equipment “pretty much” from a high of 34, CEO Andrew Klein said in an interview. He didn’t want to be specific about the job cuts.

The company, which offers products through its 160-supplier platform, is weighing price increases on its “highly engaged” customers – all part of an effort to bring more money in than out, he said.

“Next time we have to be cash flow positive or close to it. Expenses can’t exceed revenues,” Klein said. Are we 100 percent sure we can be cash flow positive? We’re not, but we’re optimistic.

The Reinen court’s fight for survival underscores the challenge of persuading large law firms to embrace new technology, especially if fears of an economic downturn cut legal jobs and pay.

In the year Law firms backing the venture, which has raised $19 million since its launch in 2018, include Latham & Watkins. Clifford Chance; Orrick Paul, Weiss, Rifkind, Wharton and Garrison; and the Japanese company Nishimura & Asahi. Latham and Clifford Chance each invested $2.1 million in 2018, Klein said.

Klein himself has invested at least $2.8 million in Prince H LLC, a vehicle he controls.

Rayen Court has 30 law firm clients so far, though it projected about 200, Klein said. “It’s fair to say we tried to do too many things early on,” he said.

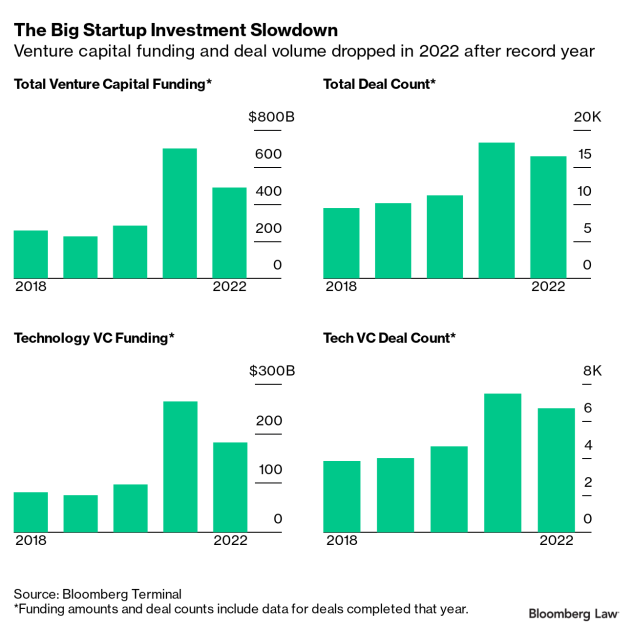

Further fundraising, whether from venture capital operations or law firms, is on hold for now. By the end of 2022, funding avenues for tech startups have dwindled in part due to a decline in venture capital funding.

“Our primary focus is on performance, not fundraising,” Klein said. “Will we be successful? We won’t know for nine to twelve months.

difficult times

Dan Jansen, CEO and managing director of Nextlaw Ventures, the legal technology venture capital operation founded by Dentons, said the Times has had a tough time in legal tech due to the lack of investor funding and the reluctance of law firms to make long-term commitments.

But Jansen said he’s optimistic about Reynen Court’s business model. Screening legal technology vendors is “real value” for companies trying to determine which products will address their needs and be used by attorneys, he said.

The legal market has benefited from Rayon Court’s services, including helping organizations migrate to the cloud, said Toby Brown, CEO of consultancy DV8 Legal Strategy.

But he says law firms sometimes struggle to understand how to benefit from services. “I wasn’t sure I understood the value proposition of the Rayen court,” said Brown, a former practice managing officer at Perkins Co.

In the year When Rayen Court was announced in 2018, a dozen prominent law firms in the U.S. and Britain and other backers of the self-proclaimed app store for legal technology said they had high hopes for the project.

Klein, a former associate of Cravath, Swain & Moore, said there are still exciting things to do on stage. The 160 vendors are up from 140 in 2021.

Ryan Court said customers will benefit from a new partnership with the company to help them manage their cloud platforms. Another partnership offers 24-hour service and customer support, Klein said.

He said the identity of the partner companies will be announced in the coming weeks.

Klein said of Rain Court: The company is “certainly not dead and buried.” He admits that he has more work to do to become cash flow positive.

“I don’t think anybody wants to invest in a company that’s losing money more than every quarter,” Klein said. “And that includes me.”

[ad_2]

Source link