[ad_1]

Opec+ agrees small increase in oil output – reports

OPEC+ has reportedly agreed to raise its September oil output targets by 100,000 barrels per day, dashing hopes of a larger increase.

The decision, at today’s meeting of oil ministers, should bring some more supplies onto the market…but it’s a much slower pace than in earlier months.

For both July and August, for example, the group had pledged to raise output by 600,000 barrels, having added an extra 400k per month at earlier meetings.

The US has been pushing Opec to boost output, but President Joe Biden’s visit to Saudi Arabia last month did not yield an agreement.

However, some Opec+ members had already been struggling to deliver previous output targets, having exhausted their spare production.

Here’s Bloomberg’s take:

The 23-nation alliance would divide the increase proportionally between members, delegates said. In recent months, with only the Saudis and the United Arab Emirates able to bolster production, just a fraction of the group’s promised increases have reached world markets. There were no discussions about whether the Organization of Petroleum Exporting Countries and its allies would keep increasing production beyond September, they said.

The agreement is only a modest indication that Riyadh and Washington are on a path toward reconciliation, coming after a visit to the kingdom last month that saw US President Joe Biden greet Crown Prince Mohammad bin Salman with a fist bump. Late on Tuesday, the US approved the sale of $3.05 billion of weapons including Patriot missiles to the Middle East heavyweight.

OPEC will lift supply by 100,000 bpd, a tiny fraction of the group’s overall output and a far smaller increase than in recent months, little relief for oil market tightness.

“A bit mystified as to the point of 100,000 bpd rather than zero, for practical purposes it is zero”— Jennymanydots (@jenstilmanydots) August 3, 2022

Key events

Filters BETA

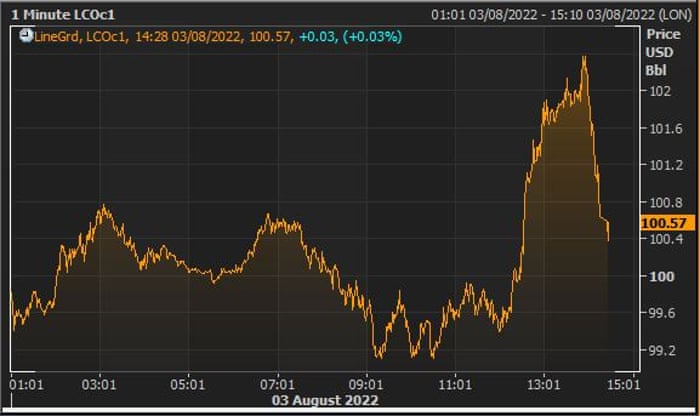

The oil price has recovered earlier losses after Opec+ decided to slow the pace of their production increases.

Brent crude rose back over $100 per barrel, after dipping toward $99 this morning.

“Chronic underinvestment in the oil sector has reduced excess capacities along the value chain”

This is what happens. No surprise here. If The Permian is struggling to find crews & equipment, then so is OPEC+ https://t.co/EHIVTuPZ3Q

— Thomas P (@Pref_Right) August 3, 2022

Opec+ has warned that ‘choronic underinvestment’ in the oil sector is making it harder to meet demand.

The group has issued a statement confirming today’s decision to increase output by (just) 100,000 barrels of crude oil per day in September.

But ii also warns that the “severely limited availability” of excess capacity means it must be used with “great caution” in response to severe supply disruptions.

The Meeting noted that “chronic underinvestment in the oil sector” has reduced excess capacities across the sector — from upstream (finding new reserves), to midstream (transporting and storing it) and downstream (refining and selling it).

This means it will be hard to meet demand beyond next year, it adds:

The Meeting highlighted with particular concern that insufficient investment into the upstream sector will impact the availability of adequate supply in a timely manner to meet growing demand beyond 2023 from non-participating non-OPEC oil-producing countries, some OPEC Member Countries and participating non-OPEC oil-producing countries.

Reuters: Small Opec+ increase is ‘insult’ to Biden

The OPEC+ plan to raise oil output by a tiny 100,000 barrels per day is being described as ‘almost insulting’ to U.S. President Joe Biden after his trip to Saudi Arabia last month to persuade OPEC’s leader to pump more to help the U.S. and global economy, says Reuters.

The increase, equivalent to 86 seconds of global oil demand, comes after weeks of speculation that Biden’s trip to the Middle East and Washington’s clearance of missile defence system sales to Riyadh and the United Arab Emirates will bring in more oil.

An OPEC+ document showed the group was set to raise output by 100,000 bpd from September and two sources said it has been effectively rubber-stamped by a close-door meeting.

“That is so little as to be meaningless. From a physical standpoint it is a marginal blip. As a political gesture it is almost insulting,” said Raad Alkadiri, managing director for energy, climate, and sustainability at Eurasia Group.

OPEC and its allies led by Russia have been previously increasing production by about 430,000-650,000 bpd a month although they have struggled to meet full targets as most members have already exhausted their output potential.

#OPEC oil output hike of 100,000 bpd is equal to about 86 seconds of world demand, based on our rough calculations. So, v. small!

— Alex Lawler (@AlexLawler100) August 3, 2022

Opec+ agrees small increase in oil output – reports

OPEC+ has reportedly agreed to raise its September oil output targets by 100,000 barrels per day, dashing hopes of a larger increase.

The decision, at today’s meeting of oil ministers, should bring some more supplies onto the market…but it’s a much slower pace than in earlier months.

For both July and August, for example, the group had pledged to raise output by 600,000 barrels, having added an extra 400k per month at earlier meetings.

The US has been pushing Opec to boost output, but President Joe Biden’s visit to Saudi Arabia last month did not yield an agreement.

However, some Opec+ members had already been struggling to deliver previous output targets, having exhausted their spare production.

Here’s Bloomberg’s take:

The 23-nation alliance would divide the increase proportionally between members, delegates said. In recent months, with only the Saudis and the United Arab Emirates able to bolster production, just a fraction of the group’s promised increases have reached world markets. There were no discussions about whether the Organization of Petroleum Exporting Countries and its allies would keep increasing production beyond September, they said.

The agreement is only a modest indication that Riyadh and Washington are on a path toward reconciliation, coming after a visit to the kingdom last month that saw US President Joe Biden greet Crown Prince Mohammad bin Salman with a fist bump. Late on Tuesday, the US approved the sale of $3.05 billion of weapons including Patriot missiles to the Middle East heavyweight.

OPEC will lift supply by 100,000 bpd, a tiny fraction of the group’s overall output and a far smaller increase than in recent months, little relief for oil market tightness.

“A bit mystified as to the point of 100,000 bpd rather than zero, for practical purposes it is zero”— Jennymanydots (@jenstilmanydots) August 3, 2022

German Chancellor Olaf Scholz insists gas turbine at centre of row with Russia works

In other energy news… German Chancellor Olaf Scholz has insisted that Russia had no reason to hold up the return of a gas turbine for the Nord Stream 1 gas pipeline.

The turbine is stranded in Germany, following servicing in Canada, in an escalating standoff that has seen has flows to Europe fall to a trickle, just 20% of capacity.

Standing next to the turbine on a factory visit to Siemens Energy in Muelheim an der Ruhr, Scholz said it was fully operational and could be shipped back to Russia at any time – provided Moscow was willing to take it back.

“The turbine works,” Scholz said, telling reporters:.

“It’s quite clear and simple: the turbine is there and can be delivered, but someone needs to say ‘I want to have it’”.

But Kremlin spokesman Dmitry Peskov blamed a lack of documentation for holding up the turbine’s return to Russia.

Ministers from the Opec+ group of oil producers have started their monthly meeting to discuss production levels.

Reuters is reporting that one proposal is to raise output by 100,000 barrels per day next month, a fairly modest increase which might ease supply shortages.

Opec and its allies had been increasing output by 400,000 barrels per day each month earlier this year – and by more over the summer – as they gradually unwound massive production cuts made early in the pandemic in 2020.

The FT is reporting that Saudi Arabia had warmed to the idea of a small increase, following Crown Prince Mohammed bin Salman’s welcome in France last week and US president Joe Biden’s trip to Jeddah in July:

The AA have joined the RAC in criticising major fuel retailers for not passing on the drop in wholesale petrol prices to drivers in full.

AA president Edmund King called it “pretty unforgivable” behaviour, that hurt motorists during the cost of living crisis:

“Average UK pump prices are down by around 9.5p a litre for petrol and 7p for diesel compared to early July. But, since early June, wholesale petrol is down 20p-25p a litre depending on whether or not you factor in VAT.

In many areas of Britain, a 10p-a-litre drop in pump prices is still a ‘pumpdream’. And that is where the fuel trade is forcing struggling drivers to play the pump-price postcode lottery.

“When you consider that many small independents have been slashing 10p and sometimes 15p off fuel, because lower costs have allowed it, the failure of bigger forecourts to do likewise is pretty unforgiveable.”

Labour MPs urge BT boss to meet unions over pay dispute

Senior Labour MPs have written to the chief executive of BT, urging him to intervene in a pay dispute which has sparked strikes by thousands of workers.

The party’s deputy leader, Angela Rayner, and shadow digital, media and sport secretary Lucy Powell urged Philip Jansen to enter into negotiations with the Communication Workers Union (CWU).

They said he should follow the lead of other chief executives and “take your place at the negotiating table to find a fair deal”.

CWU members at BT and Openreach have staged two 24-hour strikes in recent days in protest at a 1,500 pay increase which the union described as a real-terms wage cut because of the soaring rate of inflation.

BT, though, is unwilling to restart pay talks – Jansen said last week that the £1,500 pay deal offered to frontline staff was “history” and not open for negotiation.

A BT Group spokesman said:

“At the start of this year, we were in exhaustive discussions with the CWU that lasted for two months, trying hard to reach an agreement on pay.

“When it became clear that we were not going to reach an accord, we took the decision to go ahead with awarding our frontline colleagues the highest pay award in more than 20 years, representing a pay rise of around 5% on average and 8% for the lowest paid.

“We have been in constant dialogue with the CWU and we have reaffirmed our willingness to discuss how we move forward from here but it would be inappropriate to reopen negotiations on a pay award that we implemented in April, when it was due.”

The summer of industrial unrest has caused tensions within Labour, over leader Keir Starmer’s policy that frontbenchers should not join on picket lines.

Rayner and Powell met union officials in a Zoom meeting on Monday, but shadow levelling up minister Lisa Nandy did visit striking BT workers on Monday, to show supporr for constituents campaigning for better pay and conditions.

Over in Turkey, inflation has soared to a fresh 24-year high… of 79.6% in July.

Prices continued to climb, due to the lira’s continued weakness and global energy and commodity costs.

That’s up from 78.6% in June, and actually a little lower than forecast – but still the sharpest annual inflation since 2002, with prices climbing another 2% in just one month.

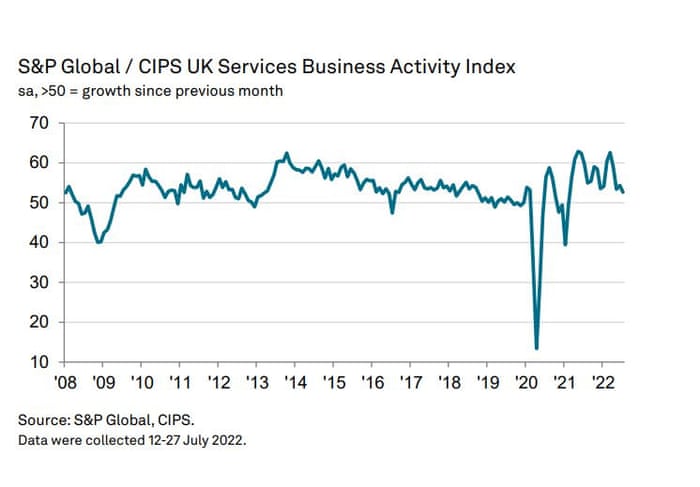

Services companies make up about three-quarters of the UK economy, so July’s slowdown is a concern — especially as manufacturing growth hit a two-year low.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said supply chain problems are still hitting growth.

“The services sector was on a go-slow trajectory in July, with the weakest level of growth since February 2021, as some ongoing shortages and subdued new business gains hindered progress.”

Anxiety over a possible recession is hitting business confidence too, Brocks adds;

“Service firms responded with a downbeat view of the next 12 months, the second lowest since May 2020, aware that the looming threat of further interest rises and recession on the horizon is unlikely to encourage consumers to spend.

French energy provider EDF could be forced to cut power output from some of its nuclear reactors as river temperatures rise due to hot weather in France.

EDF’s move adds to the energy crisis in Europe, with many of EDF’s French nuclear plants offline due to routine maintenance or defects.

Bloomberg has the details:

The French utility said late Tuesday that power stations on the Rhone and Garonne rivers will likely produce less electricity in the coming days, but there will be a minimum level of output to keep the grid stable. A heat wave is pushing up river temperatures, restricting the utility’s ability to cool the plants.

The reductions threaten to further push up power prices, which are already near record levels in France and Germany. Europe is suffering its worst energy crunch in decades as gas cuts made by Russia in retaliation for sanctions drive a surge in prices.

EdF says it’s likely to power down some of its nuclear reactors on the Rhône and Garonne rivers due to low water levels (the water is used for cooling). This is going to exacerbate the nuclear electricity crisis in France | #energytwitter #EnergyCrisis

— Javier Blas (@JavierBlas) August 3, 2022

UK services sector growth drops to 17-month low

British services sector activity growth has slowed to its slowest pace since early 2021, during a Covid-19 lockdown.

Outpur growth hit a 17-month low in July, as the economy was hit by the highest inflation in 40 years. Order books remained subdued, and confidence about the future remained at an historically subdued level.

But there were also signs that inflationary pressures could be easing a little, as input cost inflation softened to its lowest since December 2021.

This pulled S&P Global/CIPS UK Services Purchasing Managers’ Index down to 52.6, down from 54.3 in June — and weaker than the ‘flash’ reading taken in mid-July.

Tim Moore, S&P Global Market Intelligence’s economics director, said.

“UK service providers reported their worst month for business activity expansion since the national lockdown in February 2021.

Reduced levels of discretionary consumer spending and efforts by businesses to contain expenses due to escalating inflation have combined to squeeze demand across the service economy.

The near-term outlook also looks subdued, as new order growth held close to June’s 16-month low and business optimism was the second weakest since May 2020.

[ad_2]

Source link