[ad_1]

Hispanolithic/E+ via Getty Images

Investment summary

In the latest sector rotation favoring healthcare names, we look at Encompass Health Corporation (ASX: ).NYSE:EHC) and note that it exhibits many characteristics that will help further transform the future investment landscape. This is high The name Probability is working well on its growth strategy, all while maintaining a 10.2% annual return on invested capital and adequate liquidity. If profitability trends are characterized, alongside an expected business model, we would book EHC Buy at a price of $84.75, looking for a 64% return objective to that level.

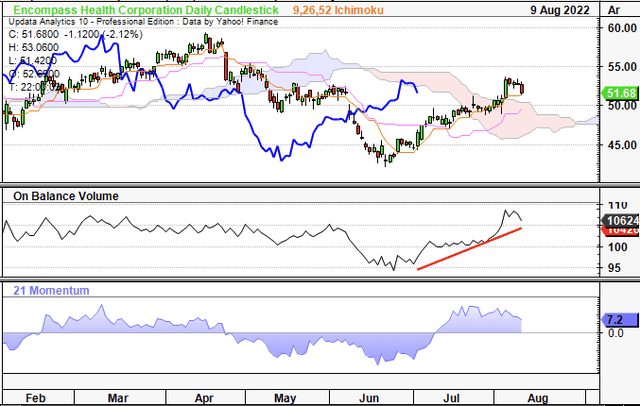

Exhibit 1. EHC 6-month price action, ichimoku cloud overlay. The price line and lag line (in blue) have each been punched by cloud support, but on a scale it shows that a long-term trend is in place. This price chart is a rough approximation.

Date: Update

Q2 earnings provide insights into FY22 exit momentum

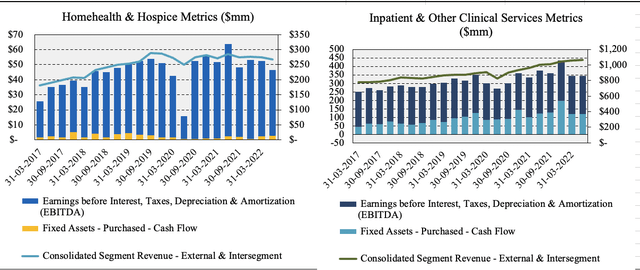

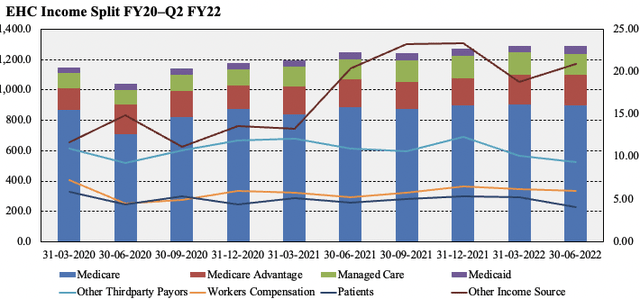

Second quarter earnings It came in strong despite publishing below consensus estimates. Total sales were. 1.33 billion dollarsIt constitutes a YOY growth of ~310bps. Of this, the Inpatient Rehabilitation Franchise (“IRF”) business contributed ~80% or $1.06 billion, bringing quarterly EBITDA to $196 million. As shown in Exhibit 2, revenue from each segment has been trending seasonally, with growth trends coming into the single digits in recent quarters.

Exhibit 2. Segment-specific revenue mix, trends back by region

Data: HB Insights, EHC SEC Filings

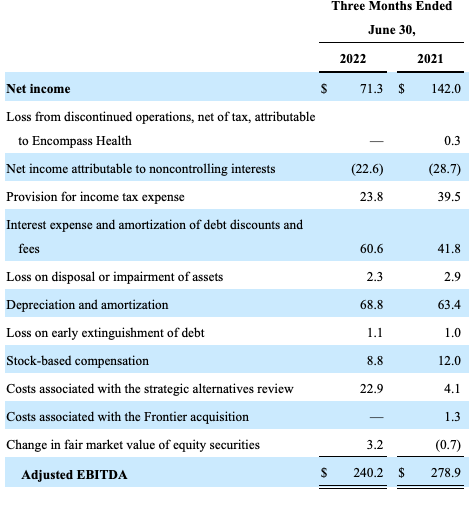

GAAP records non-EBITDA as $240 million, and explains that the adjustment is necessary to measure the company’s liquidity profile. Exhibit 3 shows a reconciliation of net income to adjusted EBITDA. We concur with most of the adjustments, except for the $8.8 million reduction in stock-based compensation and the change in fair market value of $3.2 million during investigation. As such, we adjusted EHC’s EBITDA to read $228.2 million.

Exhibit 3. Reconciling Net Income to Adjusted EBITDA – The difference between reported and adjusted EBITDA is ~22%

Info: HB Insights; EHC 10-Q; Q2 FY22

That was $95 million in operating income before taxes, down from $181 million a year ago, and $71 million in net income. The YOY change was driven by higher operating expenses in the SG&A line and a 44% increase in interest expense. As such, it turned FCF at a 12.5% margin to ~$177 million, up ~21% year over year.

Additionally, Q2 contract labor (including sign-on and shift bonuses) decreased to ~$57 million versus ~$7 million, respectively, with a mix of ~62% and ~38% paid for contract labor and bonuses, respectively. Remarkably, in the current labor market, EHC has reduced contract full-time equivalents (“FTEs”) by 20% from a peak of ~750 in March to 597 in June.

A revenue increase of 130bps per release has been lauded. However, this was offset by spending challenges caused by the revenue call’s “manpower challenges”. Despite this, it saw some benefit from Q2 agency rates, falling from $240,500 to $222,000 per FTE, respectively. These are good trends to watch because the agency’s value increased by $243,000 to the company’s high in February, and that was uncertainty over its ability to return to territory. Alas, in June, total agency value dropped over 40% to ~$209 million.

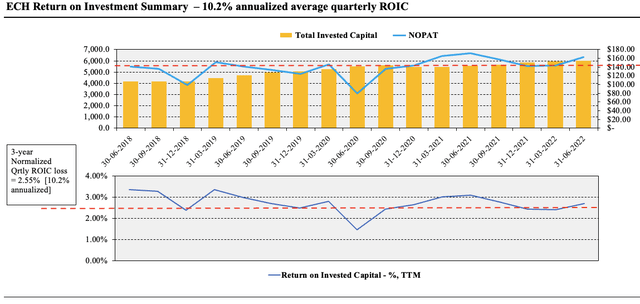

Due to the increase in sales and revenue, the company’s return on investment declined by an average of 2.69% during the quarter. Here we examined how much NOPAT EHC was generating from last year’s invested capital, and determined this as Return on Investment (“ROIC”). As shown in Exhibit 4, the 4-year ROIC is about 2.55% (10.2% annualized), greater than the company’s annualized WACC of 6.1%. This adds a highly bullish tendency to the investment debate. These are static, defensible and cash-rich EHC books. It therefore ensures that the company can continue to compound cash at an average of ~10% per annum – attractive aspects in a forward-looking climate.

Exhibit 4. ROIC trends trend upward with NOPAT conversion

Image: HB Insights, EHC SEC Filings

Instructions are checked from top to bottom

Q2 earnings were in line with internal expectations; Management saysRequesting reconfirmation of FY22 guidance. It has increased provisions for bad debt from 200bps, to a range of 200-220bps. Management has $280 million-$380 million in FCF projects from the IRF segment. It is worth noting that the YTD FCF of the segment is already at 290 million USD, and this is in line with the current trends of the higher CAPEX program in H2 FY22.

Following Inhabit’s turnaround, it issued a separate set of accounts and forward-looking guidance in June. It now estimates EHC revenue of $4.25–4.3 billion, with adjusted EBITDA of $820–840 million and non-GAAP EPS of $2.77–2.91. It also declared a quarterly dividend of $0.15cps, although this is analytically negligible, with a forward yield of 0.3% on top of that.

Exhibit 5. EHC Quarterly Operating Income Trends

Data: HB Insights, EHC SEC Filings

Further consideration

Same-store RN employees jumped more than 135% YoY to 276, setting a benchmark and turning bonuses higher in the quarter. As the company continues to hire more RNs, industry turnover remains high, and given the current state of the U.S. labor market, EHC expects both of these costs to remain in place for the remainder of FY22.

As a result, the company appears to be transitioning from contracting to this segment, and the agency’s forecast is expected to decline in line with last quarter. However, the vision is bleak here, because there is still no clarity on the Covid-19 situation, in addition, there is an ongoing shortage of workers for many other reasons (sick days, layoffs, etc.), which means that the agency’s prices may remain high for a long time, EHC predicts.

Apart from this, CMS released the final IRF regulations for FY23 in the last week of July. CMS established a ~4% improvement in the IRF basket for the final rule. So EHC will receive 4% of Medicare payments starting October this year when the new law takes effect.

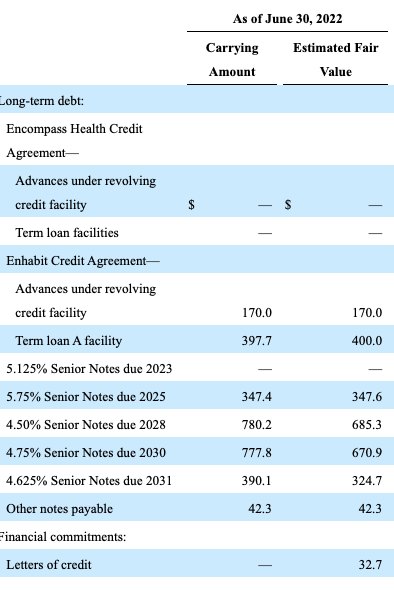

However, the bottom line is that the 400bps increase will not be enough to overcome rising operating costs and interest costs. It has $170 million and ~$398 million of outstanding revolving credit in the Loan A facility. The distribution of notes issued in Exhibit 6, below, ranges from 4.6%–5.75% coupons, and yields from FY23–FY30. A sensitivity analysis of the company’s debt structure showed that a 1% increase in commercial interest rates would lead to an additional negative cash flow of ~$3 million for EHC. The same is true for the lower side.

Exhibit 6. EHC’s credit structure with distribution of issued notes

Every 1% increase/down in interest rates totals $3 million in cash flow on this profile

Data: HB Insights, EHC 10-Q

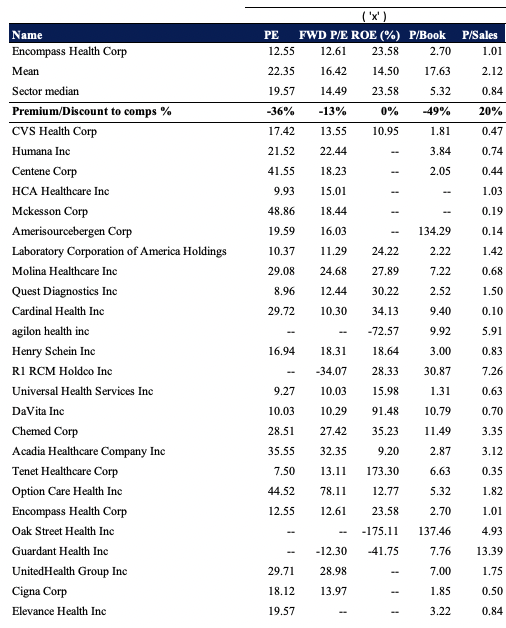

Price

Shares are trading at a discount to peers at all multiples used in this analysis bar sales multiples. Alas, it trades at a 12.6x forward P/E at a 13% discount to GICS industry peers, which the market is pricing in underperforming the sector. This creates a good setup for the company to experience significant earnings appreciation.

Exhibit 7. Plurals and Comps

Info: HB Insights

At 12.6x the company’s FY22 EPS estimate of $9.30, this would price the stock at $117, with incredible upside potential if it were to materialize at this rate. However, we know that the company has a negative realizable book value, yet it trades at 2.6x total book value and 6.8x cash flow, both at 50% and 60% discounts to the sector. EHC, however, trades at approximately 15x FY22 FCF and is valued at just $52.50 USD. Given the wide variation in distribution results, we are unsure of the mean value and use the median of all calculations to estimate EHC at a value of $84.75.

Additional data points:

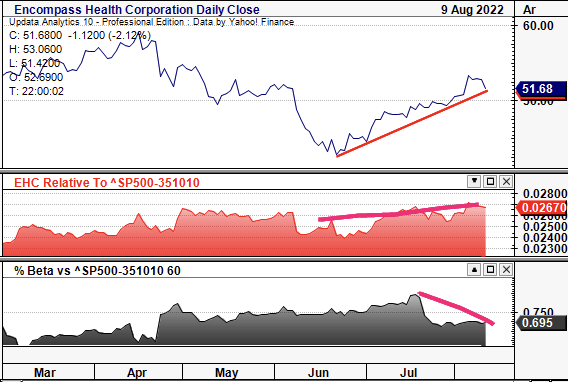

- The stock has been bullish since June, hitting 52-week lows in the process.

- At the same time, it has strengthened in the field of medical technology and healthcare providers.

- To illustrate this, we see that the EHC covariance structure during this period shifts downward after leveling off.

- Investors are rewarding abnormal risk premia in FY22 and pushing lowers, reducing equity beta is evidence of this in EHC, we reckon.

- This indicates a more supportive technical advance on the charts.

Exhibit 8.

Date: Update

in short

EHC will deliver the quality features that investors will pay a premium for in FY22. The company has an average annual ROIC of 10.2% and growing profitability to a weak economic outlook. He has also been actively involved in resolving labor management-related cost violations. This, with the recent sector shift to healthcare in H2 FY22 makes us bullish on the name. We register EHC Buy with a price target of $84.75.

[ad_2]

Source link