[ad_1]

executive summary

The Senate-passed Inflationary Reduction Act (IRA) included several health care provisions, including:

- Extend the American Savings Plan Act’s subsidies for the Affordable Care Act’s exchange for another three years.

- Basically, change how Medicare pays for Part B and D price adjustments, Part B and D inflation penalties, and out-of-pocket insulin costs.

- Structure Medicare Part D to provide out-of-pocket coverage for beneficiaries and expand eligibility for Medicare Part D subsidies for low-income individuals.

- Repeal the Trump administration’s Prescription Drug Discount Act of 2019.

Introduction

On Saturday, the Senate passed the Inflationary Reduction Act (IRA) by a 51-50 vote, the latest version of Democrats’ previous spending package known as Build Back Better. Along with climate and tax provisions, an IRA includes several health care provisions, including:

- The Affordable Care Act (ACA) exchanges extended the American Recovery Plan Act (ARPA) subsidies for another three years.

- Basically, change how Medicare pays for Part B and D price adjustments, Part B and D inflation penalties, and out-of-pocket insulin costs.

- Expands the structure of Medicare Part D to provide out-of-pocket coverage for beneficiaries and eligibility for Low Income Subsidies (LIS) under Medicare Part D.

- Repeal the Trump administration’s Prescription Drug Discount Act of 2019.

The IRA will make significant changes to the US health care system that will have an impact for years to come. Below is a brief explanation of the key provisions of the Act.

Affordable Care Act Premium Tax Credits

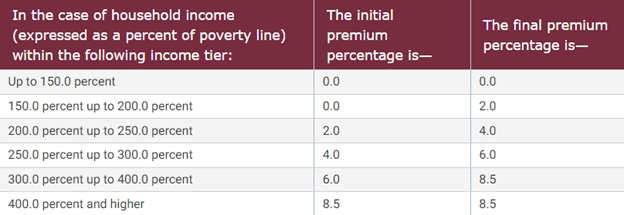

As part of ARPA’s passage, the ACA’s premium tax credits would be extended for three more years, through 2025. These premium tax credits ensure that users who get their insurance coverage through the exchange receive a subsidy so that the second lowest cost Silver plan costs an individual no more than 8.5 percent of family income. Although the ACA’s original premium tax credit was smaller than ARPA’s and not for individuals making 400 percent of the federal poverty level (FPL), ARPA increased the amount of the subsidy and expanded the number of individuals who could receive it. Figure 1 below shows the subsidy rate for a given percentage of FPL.

Figure 1. Table of premium tax credits

Source: Legal Information Institute at Cornell Law School

Medicare drug pricing requirements

The IRA also includes language requiring Medicare to pay for select drugs, which the law “Negotiation.“Drugs will initially be selected in 2023, and pricing will take effect beginning in 2026. Drugs must be selected by the Centers for Medicare and Medicaid Services (CMS) and an agreement with the manufacturer two years before the new pricing takes effect. Eligible drugs for selection must have the highest total cost in Part B or Part D.” Among the 50 available single-source drugs that are specified and have had a Food and Drug Administration approval date of at least seven years, the initial price applicability year (IPAY) has been delayed until 2029 for certain small biotech drugs. Specifically, CMS is directed to select 10 Class D drugs eligible for IPI 2026. For IPAY 2027, CMS must select 15 eligible Class D drugs. For IPAY 2028, CMS must select 15 eligible Class D and Class B drugs. For IPAY 2029 and subsequent years, CMS must select 20 eligible Class D and Class B drugs. must.

The IRA sets a “Maximum Fair Price” (MFP) for all selected drugs based on a certain percentage. The specified percentages are as follows: for selected drugs under 12 years of age (“short-monopoly drugs”), 75 percent of the non-federal average manufacturer’s price (AMP); For drugs approved within 12-16 years prior to selection (“extended monopoly drugs”), 65 percent of AMP; And for drugs approved for 16 or more years (“long-monopoly drugs”), 40 percent of AMP.

For IPI 2026, the MFP is increased by the Consumer Price Index for All Urban Consumers (CPI-U) to the percentage specified in the 2021 average non-federal AMP for the selected drug. For IPI 2027 and beyond, the MFP must be the lesser of the selected 2021 non-Federal AMP percentage by the CPI-U percentage increase or the specified average non-Federal AMP percentage. One year before the selection of the selected drug. or, if it results in a lower price, the MFP is the price paid by Part B for the year before the choice of Part B drugs, and for Part D drugs is the average of the prices negotiated by Part D plans. Discounts received by the plans.

Manufacturers who do not comply with the pricing process, including not participating in the process or agreeing to the MFP, will be charged higher excise taxes that will increase until the manufacturer is in compliance. In the first 90 days, the excise tax for the selected drug is 65 percent. Excise tax for 91-180 days is 75 percent. Excise tax for 181-270 days will be 85 percent. And for any days thereafter, the excise tax will be 95 percent. Manufacturers found to have violated the terms of the agreement or failed to provide the MFP to a Medicare beneficiary face civil penalties of up to 10 times the difference between the MFP and the requested price. Manufacturers can avoid these penalties only by complying with set prices or removing the drug from Medicare coverage entirely.

Inflation penalty

Under the IRA, single-source Class B drugs and all Class D drugs, excluding certain low-cost drugs, face penalties if the price of the drug increases faster than inflation. This penalty will be a price reduction for Medicare on all parts B and D units sold in excess of the authorized price increase.

For Class B drugs, the discount is calculated by multiplying the total number of units sold in Class B by the number of units sold. Class B drugs currently approved will have Q3 2021 as the benchmark quarter, while drugs approved after December 1, 2020 will have the third full quarter after approval as the benchmark quarter.

For Class D drugs, the discount will be an amount equal to the total number of units sold in Class D, the volume-weighted average annual AMP in a year divided by the inflation-adjusted, weight-weighted average annual AMP for the benchmark year. The benchmark year for currently approved Class D drugs is 2021. Part D drugs approved after October 1, 2021 will use the first calendar year after approval as the benchmark year.

Part D benefits redesign

Beginning in 2025, Medicare Part D will undergo a significant redesign, introducing higher out-of-pocket payments for consumers and eliminating the coverage gap. Specifically, consumers will not pay more than $2,000 out-of-pocket in a year for Class D drugs in the first coverage level, after which the consumer will immediately enter the worst-case scenario and, starting in 2024, will not be responsible for anything. Prescription drug cost sharing at risk level.

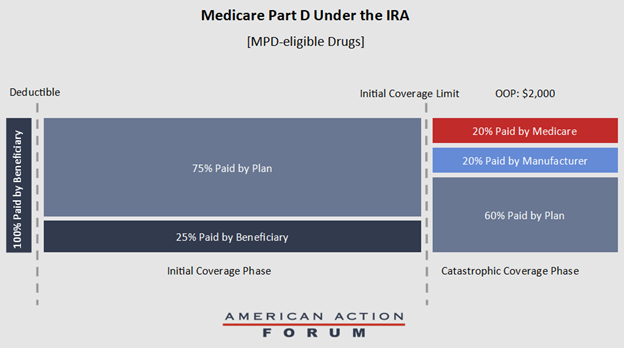

The IRA establishes a Manufacturer’s Discount Program (MDP), which requires a 10 percent discount on the negotiated price of Part D on the first level of coverage and a 20 percent discount for consumers during an accident. Eligible drugs for this discount include all Class D drugs except for the above pricing criteria. If a beneficiary in the first coverage level is prescribed a drug based on the pricing criteria, Medicare must provide the plan with a subsidy equal to 10 percent of the drug’s MFP.

Medicare reduces the reimbursement to 20 percent for MDP-eligible Class D drugs in emergencies, and 40 percent for non-MDP-eligible drugs. These changes mean that, at worst, plan sponsors will cover 60 percent of costs, up from the current 15 percent level, and, for MPD-eligible drugs, manufacturers will be responsible for 20 percent of costs. Medicare is responsible for the final 20 percent (see Figure 2).

Figure 2. Part D benefit for drugs eligible for MPD under IRA

Also, the IRA limits premium rate increases for Part D to 6 percent per year for 2024-2029. In 2030 and subsequent years, CMS will calculate base premiums using the original Part D premium formula. The IRA will also overrule the Trump administration. 2019 Prescription Drug Discount Regulations. While the rule was constantly delayed and never implemented, the Congressional Budget Office he said. The repeal would provide $122 billion in savings between 2022-2031. Additional changes to Part D include: capping consumers’ insulin copays at $35 a month, allowing consumers to pay out-of-pocket costs each month, under a cap known as “softening.” Expanding LIS-eligible beneficiaries from less than 135 percent of FPL to less than 150 percent of FPL beginning in 2024; and distribution of all vaccines recommended by the Immunization Practices Advisory Committee to beneficiaries at no cost.

[ad_2]

Source link