[ad_1]

MELBOURNE, Australia, July 29, 2022 (GLOBE NEWSWIRE) — According to CPA Australia, the Australian Tax Office (ATO) has recently resumed its debt recovery activities after a two-year pause in response to COVID-19.

The small business market alone reportedly owes $12.5 billion, and the ATO has written to more than 80,000 businesses encouraging taxpayers to resolve their debts.

While many banks will not refinance tax debt, there are still ways to repay tax debt – including with the help of business loans.

According to Liberty’s Head of Communications Heidi Armstrong, lenders such as Liberty can help business owners find the right loan to support their tax debt repayments.

“If you’re a business owner who has received a repayment notice, you might consider consolidating your debt and boosting cash flow with a business loan. Thanks to our flexible and free-thinking approach, Liberty can help businesses structure their finances to repay tax debt and source extra funds for working capital.”

Tax debt may be the result of cash flow difficulties or even personal hardships that prevent affected taxpayers from meeting their obligations on time. Even with guidance from tax professionals, many taxpayers can still carry tax debt long after it’s due.

In addition, failing to pay the debt on time will see the ATO add a general interest charge (GIC) to the amount owed. The current annual rate of 8% is calculated daily on a compounding basis and added to your account.

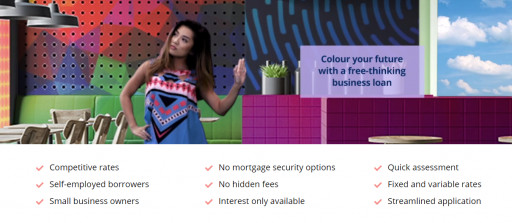

Liberty offers a range of business loans with fast turnaround times designed to support business customers to secure funds when required.

By taking a more personalized approach to business loan assessment, Liberty can tailor solutions to suit the unique circumstances of each business, helping more of them secure the funds they need.

“With decades of experience working with business owners, Liberty has the expertise to provide solutions to suit their unique needs and circumstances,” Ms Armstrong said.

Approved applicants only. Lending criteria apply. Fees and charges are payable. Liberty Financial Pty Ltd ACN 077 248 983 and Secure Funding Pty Ltd ABN 25 081 982 872 Australian Credit License 388133, together trading as Liberty Financial.

Contact

Heidi Armstrong – Group Manager – Consumer Communications

P: +61 3 8635 8888

E: mediaenquiries@liberty.com.au

Related Images

Image 1: Business Loans

Business Loans

This content was issued through the press release distribution service at Newswire.com.

[ad_2]

Source link