[ad_1]

Paul858

Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (NYSEARCA:SRVR) invests in relatively small real estate investment trusts and traditional corporations with significant technology exposure, which are sometimes referred to as tech REITs. Simplicity. Most of the revenue of these players comes from data centers, cellular towers, etc.

The sector’s typical stocks and REITs have seen strong investor attention a few years before the outbreak, and are relatively resilient to the coronavirus headwinds as their earnings are bolstered by advances in artificial intelligence, big data, cloud computing and 5G that translate into resilience. Demand for their properties, regardless of valuation, has contributed to the expansion of their trading multiples.

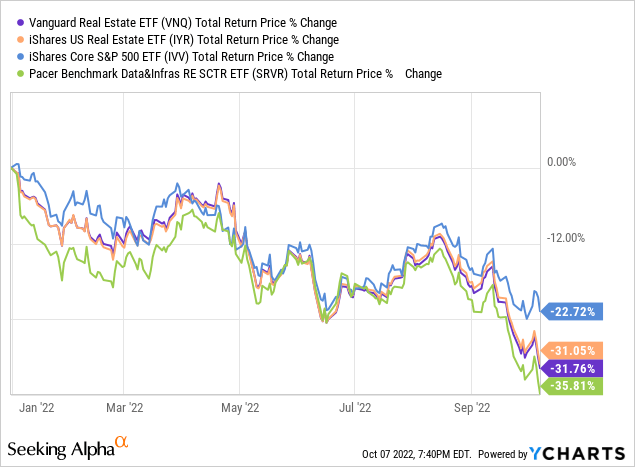

But inflation, high interest rates and a lack of capital have caused investors to shy away from names known for their generosity, and the pandemic has taken a toll on the broader tech sector at an unprecedented rate. Coincidentally, the sell-off was once again reported through tech REITs, with SRVR holdings suffering badly. After consistently delivering double-digit returns for three years since inception, SRVR is down about 36% this year, not to mention the ~33% decline in US technology barometer Invesco QQQ ETF ( QQQ ). iShares Core S&P 500 ETF (IVV).

Although many bubbles have been removed, I still highlight the risks in the mix, mainly due to the inherently generous valuation of ETFs, and the purpose of my post today is to explain the issues that should be considered before investing. Any other vehicle with SRVR or similar investment paradigm.

What is the core of the strategy?

A cornerstone of SRVR’s strategy is the Kelly Data Center and Tech Infrastructure Index, known as the benchmark data and infrastructure real estate SCTR Index prior to November 2021.

An examination of the universe of developed market companies with at least 85% of revenue from real estate operations reveals a three-stage process; These names make up the Kelly Composite Real Estate Index.

After that, the property, tenant and income types were considered to narrow down the list to those eligible for inclusion in the data center and technology infrastructure sector. In short, such companies should earn 50% of revenue or profit

Owning or managing real estate used to store, compute, or transmit large amounts of data (eg, data centers, communication towers).

There are other common criteria regarding market capitalization and liquidity, ie, companies with a value of less than $500 million are red-lighted. Rebalancing and rebalancing are done quarterly.

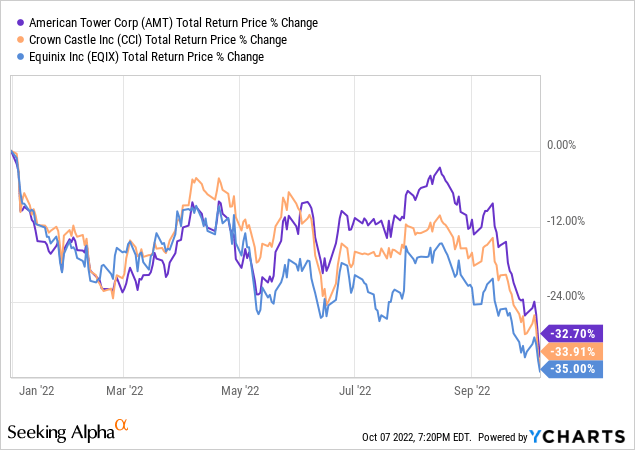

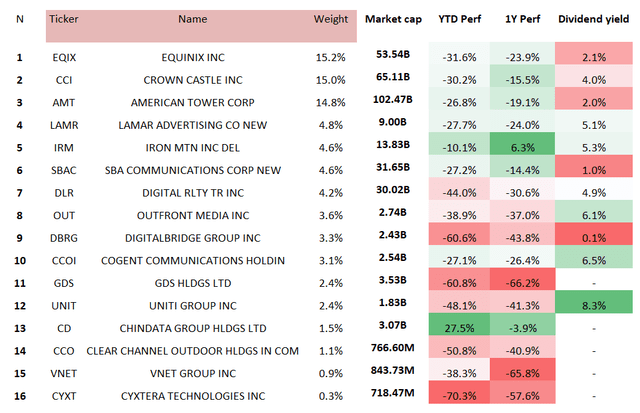

The result of this strategy is a portfolio that currently consists of 22 names, heavily concentrated in only three positions, Equinix ( EQIX ), Crown Castle ( CCI ) and American Tower Corporation ( AMT ), each sporting a minimum weighting of 15 over or under. % Valued at ~$672 million, Cyxtera Technologies (CYXT), a global data center operator, is the smallest holding in the portfolio. For this IT company 2022 was just horrible with the share price down around 75%. As the chart below shows, the year was also very challenging for the top three fighters.

In terms of sectors, real estate is expected to be the fund’s favorite, with a weight of more than 76%, in this basket there are also names of communication services, which is about 15% and IT sports ~8.9% of the weight.

It should be noted that US listed players account for the majority of the portfolio, so the higher interest rates in the US will insulate the NAV to some extent against the pressure on global currencies, but a few DM companies may also be seen as listed in London. Helios Towers plc (OTCPK:HTWSF) (London ticker HTWS). Although the remarkable softness in the pound sterling among detractors of SRVR’s performance this year defies the bears’ worst-case scenario, the impact is minimal as the stock only weighs ~1.5%.

Overall, non-US listed players account for around 18%, mostly in Europe, such as Milan-based Infrastructure Wireless Italian SpA ( OTCPK:IFSUF ), a heavyweight Italian tower operator with major customers with Vodafone Group ( VOD ), and Barcelona-based Celnex ( OTCPK :CLLNY), has wireless telecommunication infrastructure assets in France, UK, Netherlands, Italy etc. to name a few. In this regard, further developments in interest rates in the Eurozone and the possibility of a full-scale rate hike should keep the euro lower, thus feeding SRVR returns.

A closer look at performance

As I said above, due to rising interest rates in the US and the impact of investors’ risk appetite, a strong deal of past gains have been removed from SRVR this year. Incidentally, this was the case for other real estate plays, such as the iShares US Real Estate ETF (IYR) and the Vanguard Real Estate ETF (VNQ), while the decline in growth was dominated by more expensive capital.

If we look at US-listed players in the ETF portfolio, one name has somehow managed a positive return this year, and a strong one, namely Chindata Group ( CD ), a carrier-agnostic hyper-scale data center solutions provider. with operations in key Asia-Pacific developing countries. Others are in red, the aforementioned CYXT is the weakest.

Data as of October 6 (using author-generated data search alpha and fund)

Price and quality issues under the hood

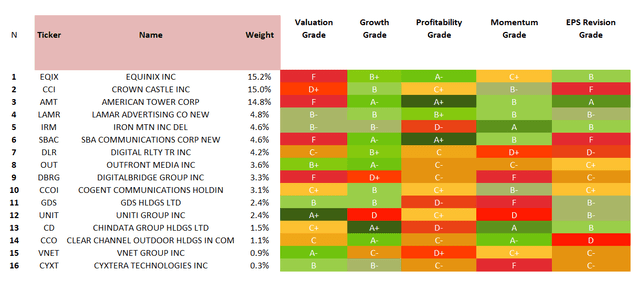

The question is whether this softness should be considered a buying opportunity. I would like to answer that question with the chart below.

Data as of October 6 (using author-generated data search alpha and fund)

What we see here is a meaningful share of companies that value perfection; Specifically, ~53% have a D+ Valuation grade or worse.

The fund’s ~1.6% dividend yield is another indication of a valuation problem. This is partly a consequence of the non-payment of dividends by a few holdings, while a sign of the devaluation of others is reflected in the worsening multiple. Furthermore, the quality seems questionable as less than 40% of holdings have at least a B-profitability rating.

The large exposure to the growth factor (over 75 percent) is an advantage worth mentioning, but I am skeptical about choosing growth over quality and value at this point.

Final thoughts

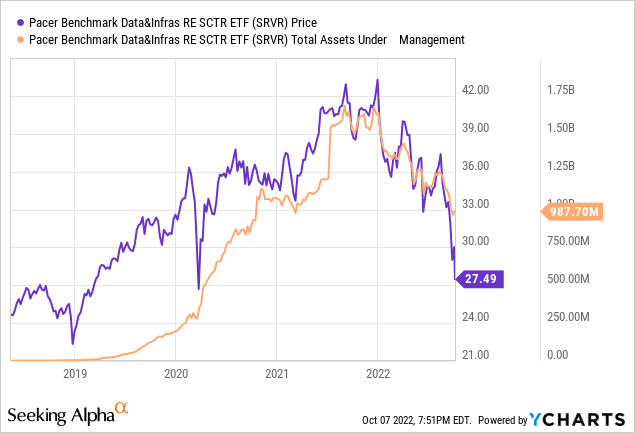

Rock-bottom interest rates, which have contributed to the outperformance of technology REITs, have provided the perfect backdrop for their assets under management to grow by around 10x from mid-2019 to mid-2021.

However, its ultra-loose monetary policy has contributed significantly to persistent inflation, which has been exacerbated by supply chain issues and the energy crisis, fueled by skyrocketing crude oil prices. As soon as the Falcon moved in, SRVR’s performance stopped.

Despite its boring use of a hybrid strategy with mostly strong income-characteristic REITs and exposure to the high-growth technology sector, SRVR is truly exceptional and deserves to be kept in a long-term portfolio. However, it is questionable whether the time is right to add it. I have highlighted the main risk assessment by evaluating the short-term performance. Growth is a silver lining, but with soft quality and risky assumptions, this mix is not worth buying.

[ad_2]

Source link