[ad_1]

Andreas

Weave Communications, Inc.NYSE:WEAV) recently entered the Canadian market, hiring a large number of employees. In my view, WEAV is at a very good time and is very undervalued. It will be my discounted cash flow model, successful campaigns, additional partnerships and in-house product development. Bringing free cash flow. Yes, there are also risks of bad customer service or reputation loss, but the downside risk seems very limited.

Weave Communications: Creative services for mass communications and a diverse client base

Wave provides customer communications for small and medium businesses. Customers use the company to focus on its business model and maximize customer relationships outside the company.

Among the services that impressed me was the ability to identify new customers who need special attention. The company offers group messaging solutions, email marketing and automated responses to comments and reviews. I believe these tools are very innovative:

Weave offers a smart phone system that helps businesses identify whether incoming calls are from new or existing customers.

Weave provides a modern, secure group messaging solution that helps businesses and their team members communicate with each other from their workstations, enabling instant collaboration to delight customers.

Weave Reviews helps businesses request, collect, track and respond to reviews on sites like Google (GOOG) or Facebook (META). Source: 10-K

The number of customers is amazing. As of December 31, 2021, Weave Communications reported 22k customers in the United States and Canada. Many clients work for very different industries. I believe the difference is very important.

As of December 31, 2021, we had more than 23,800 subscriber locations and more than 22,000 customers in the United States and Canada.

These clients represent many industries, and most are in dentistry, ophthalmology, veterinary medicine, physical therapy, home care, audiology, medical specialty services, and podiatry. Source: 10-k

Good financial shape: more assets and less debt

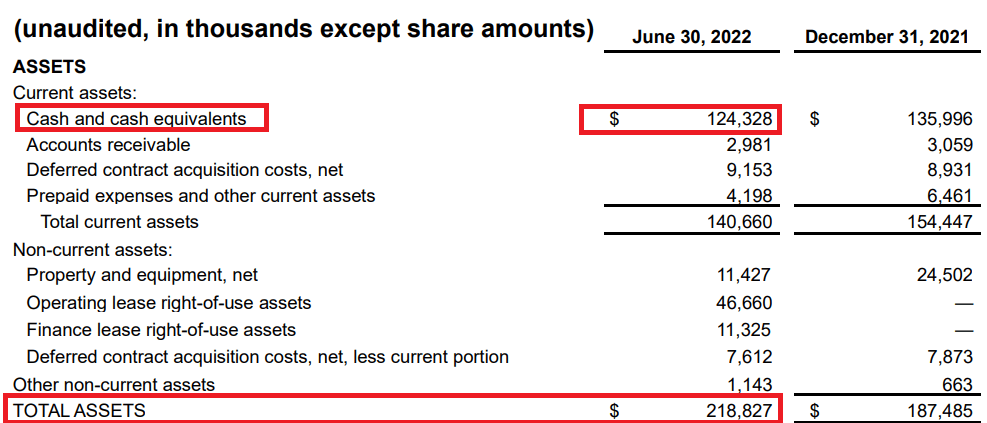

As of June 30, 2022, Wave Communications has cash and cash equivalents of $124 million, which is $124 million in cash and cash equivalents. It is slightly less than in 2021. Regarding non-current assets, the company stated that it has $11.427 million worth of property and equipment and $46 million in leases. million. Finally, Weave Communications cited a significant $218 million in assets compared to the December 2021 figure.

10-Q

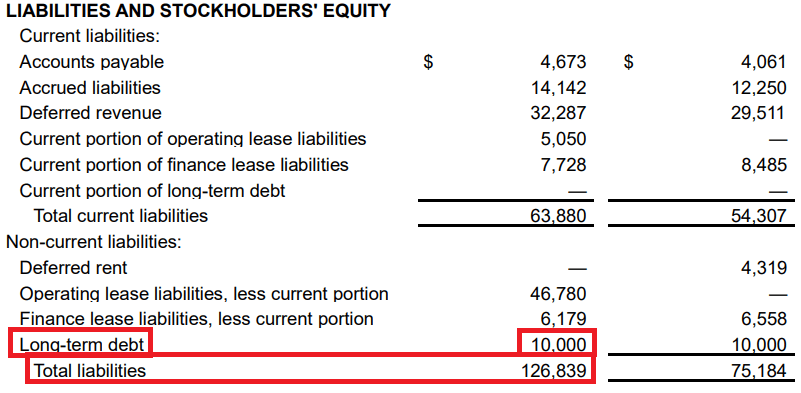

Weave Communications cited $4.6 million in accounts payable, with a total of $14 million in accrued liabilities. Regarding non-current liabilities, we found that operating lease liabilities were $46 million and finance lease liabilities were $6 million. Finally, management reported long-term debt of $10 million and total liabilities of $126 million.

10-Q

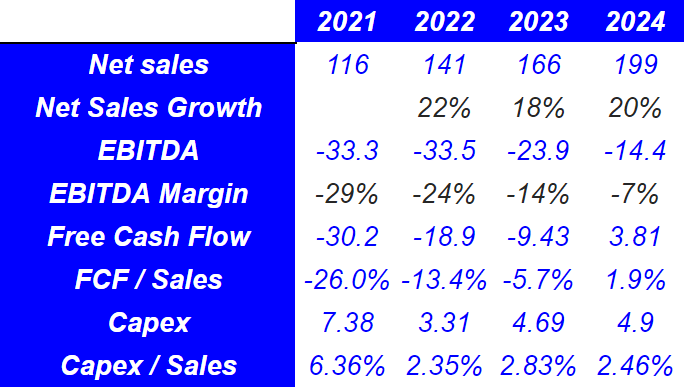

Expectations include double-digit sales growth, increased EBITDA margin and positive free cash flow.

Expected total sales of $199 million for 2024, net sales growth of 20% and EBITDA – $14.4 million. Market analysts expect EBITDA margin to decrease from -24% in 2022 to -7% in 2024. Free cash flow estimate is expected to be $3.81 million, FCF/Sales is expected to be 1.9%. I recommend readers to look at the numbers below. My numbers for the next decade are not far off from other analysts.

Seeking Alpha

Conservative case scenario

In my view, considering the tools used by Weave Communications, the target market can be related to the AI marketing market. The company discussed some of its AI services in corporate documents:

We provide support staff based on phone, AI-based support solutions, web-chat and email to resolve technical and operational issues for our customers. Source: 10-k

The artificial intelligence marketing market is expected to grow by more than 28 percent. I’d say the Weave’s sales growth may stop with the target market.

The AI in marketing market will exceed $48.8 billion by 2030, growing at a CAGR of 28.6%. Source: Globe Newswire

In my view, generating leads may not be that complicated for Weave Communications. I believe that management is taking advantage of what customers receive from the company. The company uses long marketing tools to sign new service agreements with new customers. In that regard, I don’t know what could go wrong:

Our marketing team focuses on generating demand and increasing brand awareness through a multi-strategic and multi-channel process. Leads are generated primarily through traffic to our website in a number of ways, including paid advertising, digital events, sponsorships, ad placements, email campaigns, social media, free content, blogs and organic searches. Source: 10-k

In my view, management generates a large number of leads thanks to partners, technology distribution companies and integration partners. Management discussed these partnerships and business agreements in its previous annual report:

These partners include technology integration partners, key opinion leaders, IT-installers, purchasing groups, partners and distributors. These partners refer clients on a mission basis. These referrals are forwarded to the sales team for closing. We also focus on growing our channel partnership programs to promote and sell our products directly through partners. Source: 10-k

Finally, I believe it would be very beneficial for management to fund its own engineering and product teams to innovate and deliver products. In addition, if the company can successfully cooperate with a few customers while developing new solutions, new products can meet the needs of customers. As a result, I’d say free cash flow could go north.

Our engineering and product teams strategically approach product design to serve our broad customer base and develop customized features and products to meet the vertical needs of each SMB. Our engineering team also coordinates the use of open source technologies through in-house developed code to deliver a cohesive experience to the customer. Source: 10-k

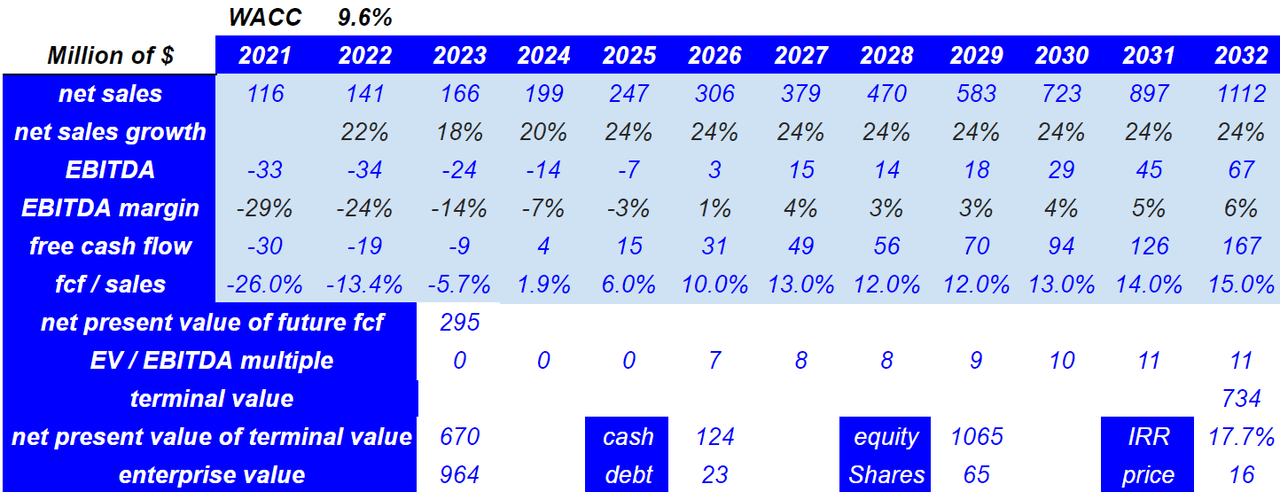

In the year By 2032, I expect to see net sales of $1.112 billion, 24% net sales growth, and EBITDA of around $67 million. I also expect EBITDA margin to be 6%, and foresee 2032 free cash flow of $167 million with FCF/sales of 15%. The future FCF net present value in 2023 is $295 million.

At an EV/EBITDA multiple of 11x, I got a terminal value of $734 million and an NPV of $670 million. Assuming $124 million in cash, the results include $1.06 billion in equity and a 17.7% internal rate of return. Finally, with a volume of 65 million shares, the target price will be $16.

My DCF model

Declining sales growth or reputational damage could push the stock price to $5.

I would say that the expansion of the company may be reduced in the near future. Weave Communications recently launched its operations in Canada and has increased its headcount significantly over the past two years. In sum, growth slowdowns are likely to occur in the near term as large firms grow more slowly. As a result, some investors may sell their shares, resulting in higher equity prices. If demand for the stock decreases, the share price may also decrease.

We recently expanded operations outside of the United States, including launching sales operations in Canada in 2020 and establishing engineering and administrative operations in India in 2021.

We expect our growth rate to slow due to various factors. Source: 10-k

In its annual report, the management admitted that it has received criticism from customers from time to time. A company’s reputation may suffer if it faces defamation as its customers post harmful comments on social media. As a result, management may lose customers, and revenue growth may not be as high as expected.

From time to time, our customers have complaints about our platform and products, such as pricing and customer support. If we do not handle customer complaints effectively, our brand and reputation may be harmed, our customers may lose confidence in us and may reduce or stop using our products. In addition, many of our customers discuss Internet-based products and services, including our platform and products, on social media. Source: 10-k

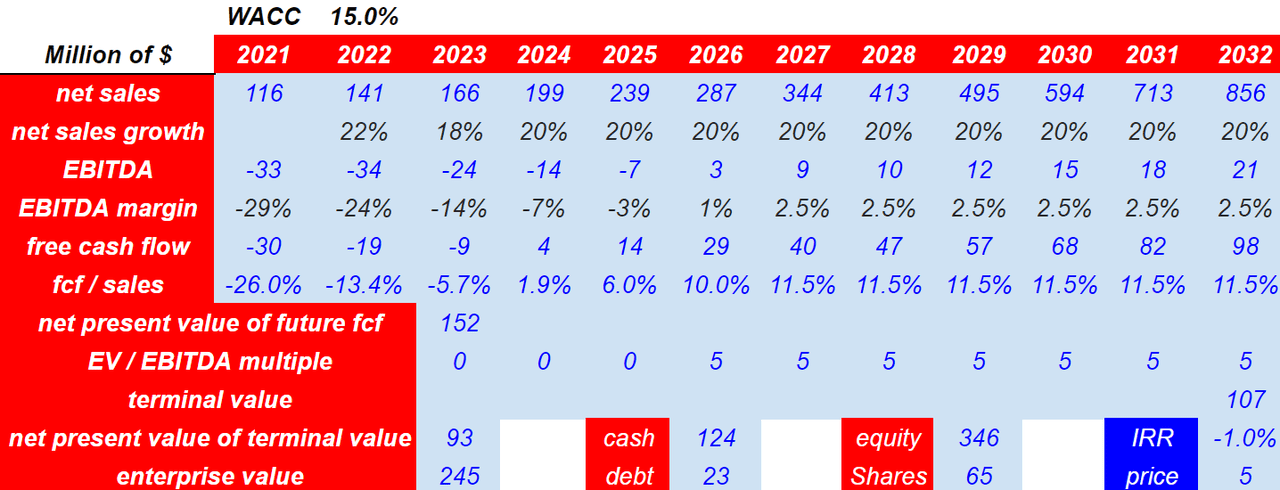

In previous estimates, I expected 2032 net sales of $856 million and net sales growth of 20% and expected 2032 EBITDA of $21 million with an EBITDA margin of 2.5%. Also, with free cash flow of $98 million and an FCF/sales ratio of 11.5%, the future FCF NPV would be $152 million.

If we use a conservative EV/EBITDA of 5x and a WACC of 15%, the terminal value NPV would be $93 million. Additionally, with $124 million in cash and $23 million in debt, equity is close to $346 million. Finally, with the number of shares outstanding at 65 million, the fair value of the implied offer would be $5 per share.

My DCF model

Conclusion

With plenty of cash and a recent expansion into Canada, Weave Communications looks pretty cheap at its current market price. In my opinion, if the company’s marketing campaigns continue to work and more partnerships are signed, the stock price could rise significantly. The company has sufficient liquidity to finance further in-house product development and drive sales growth. Given the risks of negative feedback from customers on social media or slow growth, the company appears to be undervalued.

[ad_2]

Source link