[ad_1]

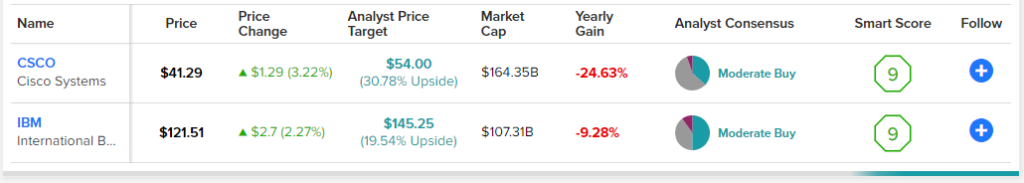

Tech stocks have been decimated this year, with speculative and unprofitable innovators leading the charge. The shock has been felt across the sector, with profit giants and tech dinosaurs also feeling the downside. Still, in this piece, we’ve used TipRanks’ Comparison Tool to find out which old-school tech stock — CSCO or IBM — is the better buy based on Wall Street estimates. Based solely on supported capacity, Cisco (NASDAQ: CSCO) seems like the best option, but let’s dig deeper.

This isn’t the first time old-school tech companies like Cisco and IBM (NYSE: IBM) have gone through technology-driven bear markets. The dotcom bust of 2000 left a “scar” on every company’s stock price. While this may not be the conclusion of the current tech- and rate-driven bear market, I think shares of both companies have overextended themselves to the downside.

Unlike many companies during the 2000-01 tech bust, Cisco and IBM are both very profitable companies. Although growth prospects have shrunk in recent decades, both companies are still able to generate more power in this high-interest environment.

Now, higher prices are not good for any organization looking to reinvest in long-term growth projects. However, they have a negative impact on smaller, less liquid companies that cannot reach GAAP profitability.

While a tilt from the Federal Reserve is possible in the coming months, investors who aren’t overweight unprofitable companies may not be the same again. Call 2022 the second coming of 2000 if you want, but Cisco and IBM are ripe (and profitable) to recover from recent trauma.

Cisco Systems (CSCO)

Cisco is a networking kingpin that hasn’t recovered from the dot-com bust (not including distributors). In the year Despite coming within striking distance of 2021, the stock now finds itself in retreat, nearing lows not seen since the depths of 2020. 35% below its all-time high, Cisco is roughly down with the Nasdaq Composite. Exchange.

Unlike its peers on the Nasdaq, Cisco stock is incredibly cheap at 14.6x trailing earnings and 3.2x sales. With a dividend yield of ~3.7%, Cisco is an attractive high-yielding stock for bargain hunters.

Now, growth may be limited to single digits as network hardware sales slow in the recession. However, with such a wide range of reversals and reversals, it is difficult to do a rain check as the stock looks to touch a strong support level around $35-$36.

Cisco is a networking behemoth that might be less exciting, but it should be seen as a staple. Like other hardware companies, Cisco is looking to expand its mix in software. Such a move should have a net positive effect on the margins going forward.

One big knock on Cisco is that it is likely to fall behind more innovative and high-growth companies. Undoubtedly, Cisco has aged significantly since its last technology-driven collapse, and its growth prospects are a little less exciting than companies of its size. Cybersecurity is one area where Cisco needs a jolt.

Networking and security go hand in hand. With the growing number of cyber threats and potential cyber adversaries, Cisco may need to dip into its budget to secure a cybersecurity deal.

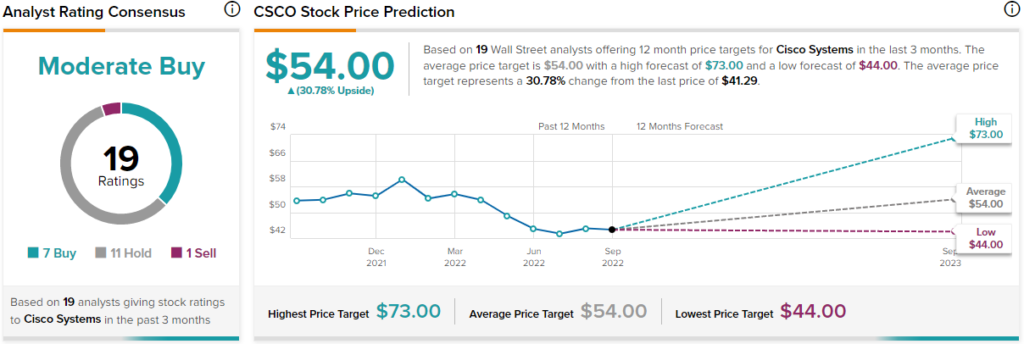

What is the price target for CSCO stock?

Despite macro headwinds, a lack of exciting growth prospects and disappointing quarterly results, Wall Street continues to do well on Cisco. CSCO’s average stock price target of $54.00 indicates a potential upside of 30.8% from current levels. If the dividend is included, this is a gain of nearly 35% in the coming year.

IBM

IBM is another old tech company that has lost its way. The stock is down more than 40% from its all-time high, not seen since March 2013. That’s a decade long bear market. This is the kind of stick that even Warren Buffett wanted out of stocks many years ago. Buffett’s exit so far has proven his genius.

The company may not have the most attractive growth profile, but it offers a very compelling valuation. At 20x trailing earnings and 1.8x sales, IBM is cheaper than other tech stocks. Although it is worth noting that the company is cheap for very good reasons.

In the latest quarter, IBM made excellent progress, with strong margins and revenues up 9% year-over-year (the best top-line growth number in several years). Despite the promising numbers, reduced cash flow guidance served as a hair piece on what was a sound quarter.

Indeed, IBM managers are shooting for top-line growth in the mid-single-digit range. However, doing so in a post-recession year can be challenging. I think a flat fall in the 4-6% top line growth range sets the stage for an established company.

IBM may not be the same company as before, but its customers still stand by it. Ultimately, IBM’s Watson AI remains a wildcard that could positively impact materials at some point in the future.

With a juicy ~5.5% dividend yield, IBM remains a dividend investor favorite. Although IBM’s turnaround path remains murky, its depressed valuation and dividend look attractive at a time when the price is rising.

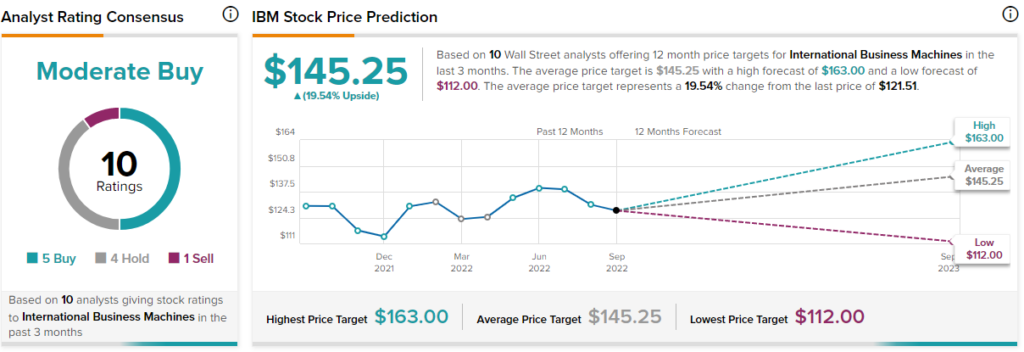

What is the price target for IBM stock?

Wall Street remains bullish on IBM shares, with a “moderate buy” rating. The $145.25 average price target for IBM stock indicates a potential upside of 19.5% over the next 12 months.

Conclusion: Cisco may be a better bet

Although IBM has shown promise with its big growth in several years, the stock has given false hope to investors for many years. Cisco looks more capable of breaking into new highs. Wall Street analysts think CSCO stock is a better bet, with several years ahead in the cards.

Disclosure

[ad_2]

Source link