[ad_1]

Scott Olson

The concept is really simple.

It’s been a bloody and painful process, as evidenced by Friday’s market performance. However, Mr. Market seems to be trying very hard to hold the line and not let go of it by anthropomorphizing it. SPX dropped to 3200. To me, that level still seems incredibly low, and I, of course, expect that we are already going down. I will admit that the technical analysts I admire the most are pointing to that extreme level as the last supporter. I remember a ton sequence where the character draws a line in the sand and the monster on the other side crosses it without hesitation. So our hero draws another line, and on and on he goes. I realize that I am the one expressing myself, in my case, earlier this year I set a higher line than where we are now and declared it impossible to cross and it still is. Still, one could look at that data and say the bottom is forming. Did you know this was an extra week for both the NDX and SPX? While the NDX is down less than a point for the week, it has withstood the negativity and weathered the onslaught. The SPX gains are worth noting, and as I’ve explained below, I’ve charted what I see as part of the downward trend. Now let’s move on to the main topic…

OK, so what do I mean by slow growth quality large cap stocks performing like tech stocks? Let me show you an example:

JPMorgan (JPM) 52WH is 173, 52WL is 104 and JPM is currently trading up a point. Quite simply, the stock is selling at a 40% discount to ATH. I’m sure many would agree that the Fed will stop tightening or at least adjust its tightening to .25%. We are not far from the time when everyone agrees that the Fed is turning the tide. When that happens, the JPM hyperbolic should return to its previous high. In fact, when the beating stops and the curve starts to flatten, NIM will grow and JPM’s overall profitability will increase, as will the stock market and buyout fees that normally work with IPOs. Will he get all 40% back at once? No, but the data backs me up, most gains in recovery are made in the first few days. I wouldn’t be surprised if JPM goes up 20% in a week or two. Meanwhile, it’s yielding 3.7% while you wait. This can happen sooner than you think, so don’t wait too long. Let’s look at the other one.

Proctor and Gamble (PG) This week 52WL hit 124, and ATH was 165 so the discount is about 25% and it is yielding about 3%. It hasn’t reversed much, but it did break the bottom of the previous low Friday so it may fall a bit. Still, if you have a long-term investment account, and I hope you do, PG is dropping about 3% right now. As well as coming to you on such a discount, being a dividend aristocrat will definitely return a large percentage of this discount in a short time. In fact, with a little more visibility, I’d bet that the buyout of most of these companies would actually start. I recommend starting now when it’s scary, so you can take part in the juiciest returns. Remember what Virgil said “Fortune favors the brave”.

Costco (price) I’m using this as an example of being thoughtful; June’s low of 447 is the current price of 468, and the high was 612. So currently, the potential gain is 24%, but it is only a .77% dividend. COST is a fantastic retailer (which it is) and despite the low dividend you may decide it’s worth investing in. Our way of investing in stocks in very small increments in COST can be considered as a welcome development. But, for our purposes, I’d like to see a slightly larger dividend to preserve the damage. COST can go down in this crazy market, maybe if the COST dividend is over 1% it will put me over the line.

So to summarize: 1) Look for large-cap stocks that have fallen 25% or more in the S&P 500 and make sure the stock doesn’t have internal issues. I’m focusing on non-tech names because I spend a lot of time with “tech titans”. I think this can be a more conservative way to find non-tech names that are easier to understand than tech names but give “tech-like” returns. Also, we’re constantly hearing that tech stocks are vulnerable to inflation and rising interest rates. Although he vehemently denies that – will Alphabet (GOOGL) hurt more than a tech company? i don’t think so. If you go through the SPX and it has a good dividend and is down 40% like JPM, you can get a “tech” type of alpha. Because this bear market has over-punished the big, established names. As part of my central premise for the last 2 weeks, we’re going down. We will see the end of the Fed collapse becoming a reality. Finally, recalling our friend Virgil’s maxim, “Fortune favors the bold,” in this case, let us take the modern meaning of the word fortunate. Warren Buffett says, “Wealth is found in recessions.” In this case, it is done when you fear the decline of wealth. Now let me try to explain why we are going down and how we are using Dual Mind Research.

Monday and Tuesday were another sharp bear market rally for the NDX and SPX, up nearly 6%.

Let’s think about that for a moment. Over the decades, the market has often gained 6% annually. Change is not fun if you don’t expect it. Most of you have been told that you cannot “time” the market. It is one of those articles of faith and if you challenge it, there will be arrows on your back at the end. Trust me, I know. We don’t recommend goat bellies or tea stains, but the market is very sensitive to inflation-related information at these times. We have seen business activity related to the upcoming data release and have subsequently reacted to the news. The trick is to guess what the market’s reaction will be. Whether the news is good or bad, it is better to have a business arrangement.

Wednesday gave us reason for optimism.

Wednesday’s price action was significant. The stock market had good reason to sell off hard today with the news that OPEC is cutting supply by 2 million barrels (actually 500K). Initially, the market was oversold but towards the end of the day, it dipped into the green to give up the gains in the last 15-30 minutes. Although it retreated, it closed to flat. Price is real.! What I’m saying is that it wants to get out under the constant swings in the market. Thursday and Friday masked Wednesday’s price action and gave us all stomachaches. In my mind, most of the selling, especially the decline over the weekend, was fear of what was to come next week. There are 3 things coming this week, 1) The minutes of the last FOMC meeting resulted in a .75% increase. Sometimes there are hints of future changes, and in our case it is more likely to see further hawkish statements. 2) PPI and 3) CPI.

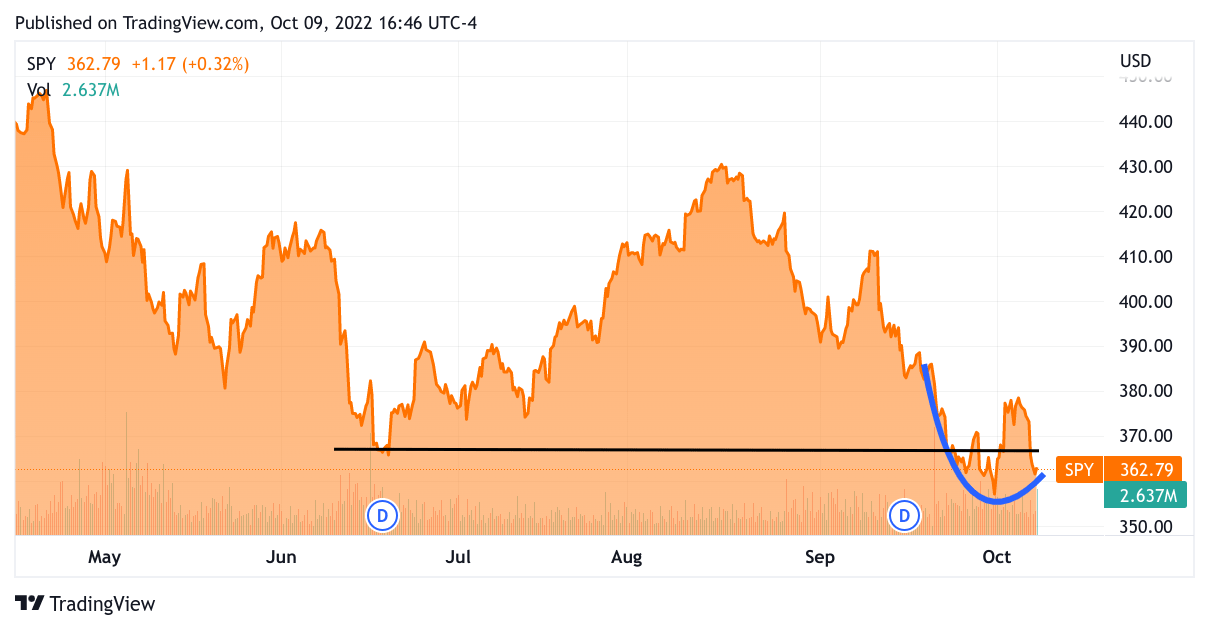

So can I say that the market is going down when the market is very heavy? Are you surprised that this week ended on a positive note? We ended up with the S&P 500 up 1.5%; The Dow Jones Industrial Average rose 2.0%; The Nasdaq Composite added 0.7%. Yes, we went low in June and slightly. Let’s look at the S&P 500 ETF (SPY).

Trading view

The blue line is trying to say we are getting off base. Although it contradicts my own case, I am showing a black horizontal line showing that we have broken the June low. The point I want to make is that yesterday many sales were looking at the very important CPI. In fact, I wouldn’t be surprised if tomorrow morning (at the time of this writing 4:53 pm the future is not yet open). Since the Dual Mind Community is disciplined in cash management, we’ll cut to that pop if that happens. I have many reasons to say we are going downhill. Early on, as the year draws to a close, the Fed’s capacity to raise is limited. The extreme volatility is not what I described, but is beginning to be replicated in various corners of the financial community. The last thing Jay Powell wants to be known for is starting a global credit crunch here. This is especially true because there are clear signs that the economic slowdown and inflation are coming from jobs, housing, used cars, food and energy (for now).

A big part of what I think is optimistic is very strong seasonality.

Strong seasonality means that when you have very inflated sales prices in September, the SPX is down 9.3% this year, with a return of 16.6% from October’s 91%. This is based on data from 1928 and mid-term elections.

Market participants were strongly selling the market on Friday, as the financial media speculated that the unemployment number. not sure.

Let’s take a moment to crunch the numbers; Total nonfarm payrolls rose by 263,000 in September. Monthly job growth averaged 420,000 in 2022, compared with 562,000 per month in 2021. In September, significant employment gains occurred in leisure and hospitality and healthcare.

Hence, there has been a distinct decline in the job growth rate this month. Ironically, more people are returning to the service sector to reduce inflation. Especially in the entertainment and hospitality sector, we constantly hear that it is impossible to find workers. As far as health care goes, I’m not sure wages can go down because the demand is so dire, and they shouldn’t be. I would say that most people in that field would improve on more sharp increments.

The Federal Reserve is raising rates to fight high inflation, and that’s weighing on stocks. Yet anyone who has followed Wall Street’s traditional advice to buy bonds may feel nauseous because they increase diversification and reduce risk. Bonds are having their worst year in history. The only asset class that gained alpha last quarter was cash — up more than 1 percent.

We believe a weekly pattern is forming.

This is key to how we approach the market we are in today. Market participants sell wildly, or maybe it’s the short sellers who are running the table at this time. Once they feel they have pushed the market as far as they can risk, they start covering. That’s what makes these bear market rallies such a paddle, if you’re late in the draw you’re selling at any price and with little alpha, but at least you’re full. So as risky as what we do at Dual Mind Research may seem, it’s far less risky than letting the shorts play with our hard-earned dime. Our guess is that by the time the shorts roll around on Thursday, he’ll have exhausted the damage and may cover it by then. If the CPI actually improves, the return will be stronger. Our two-brained research community works on marketing plans based on that premise. Sometimes we organize group business together. It is exciting and encouraging in such situations.

My business

Being tactical over the past few weeks, health stocks ranging from biotech to health services have outperformed the rest of the market, followed by oil names. I have been stockpiling shares in Bluebird Bio (BLUE), Cano Health (CANO), Haleon (HLN), Exelixis (Plodding way).EXEL), Progni (PGNY), Biohaven Ltd. (BHVN), Illumina (ILMN), Seattle Genetics (SGEN), Sarepta (SRPT). I have small spots to start with and if we have the inevitable sell off going into the CPI announcement I will add to these names. I will also add some of my oil names that you all should know if they are uploaded. I only add up to my tech titans if they are below my average price for each position. I look at at least one well-known large-cap S&P 500 that has a good dividend and is at least 25-30% below its 52-week high. I’m excited to share a name that I use this method to critique.

Remember “wealth favors courage”.

[ad_2]

Source link